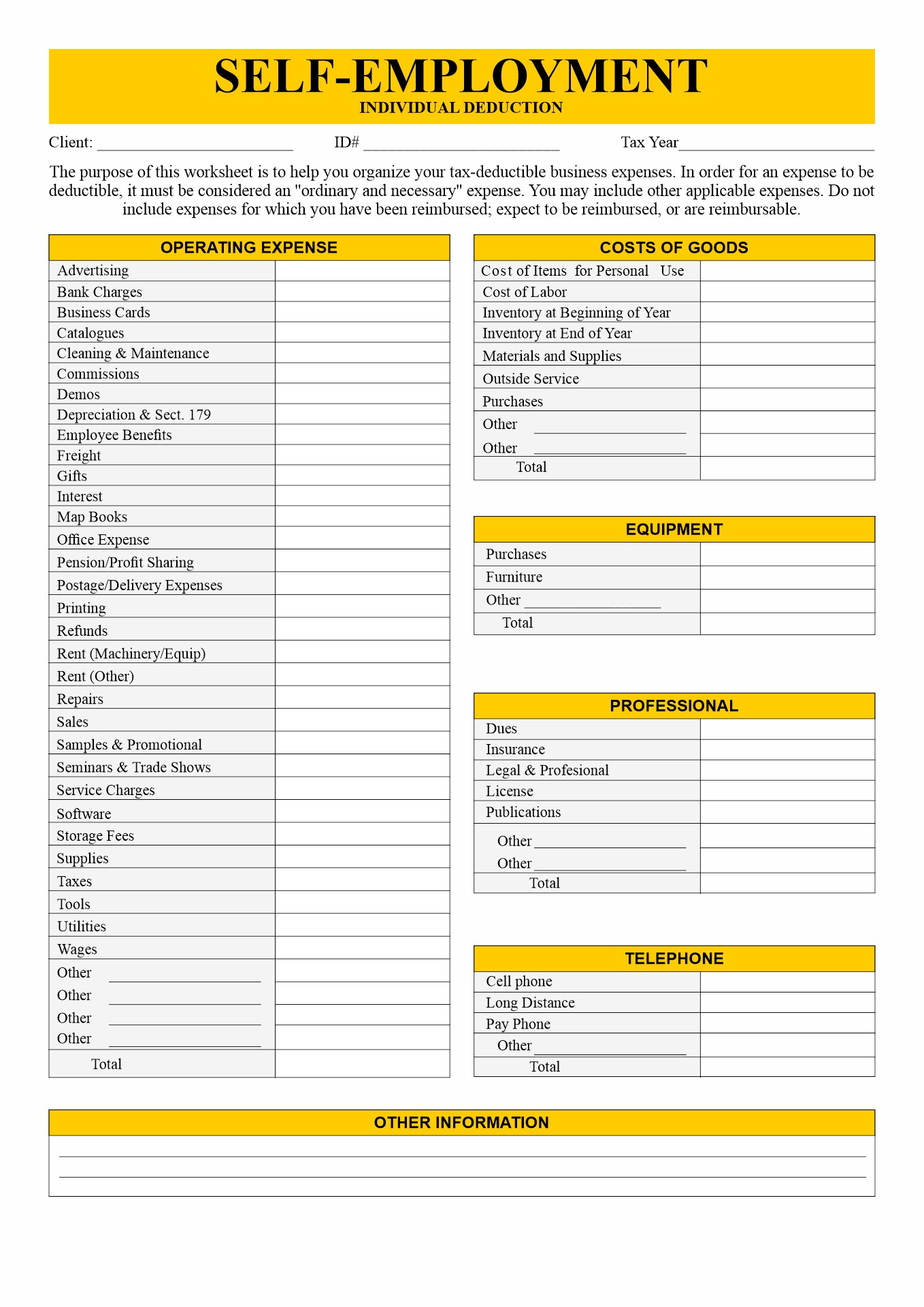

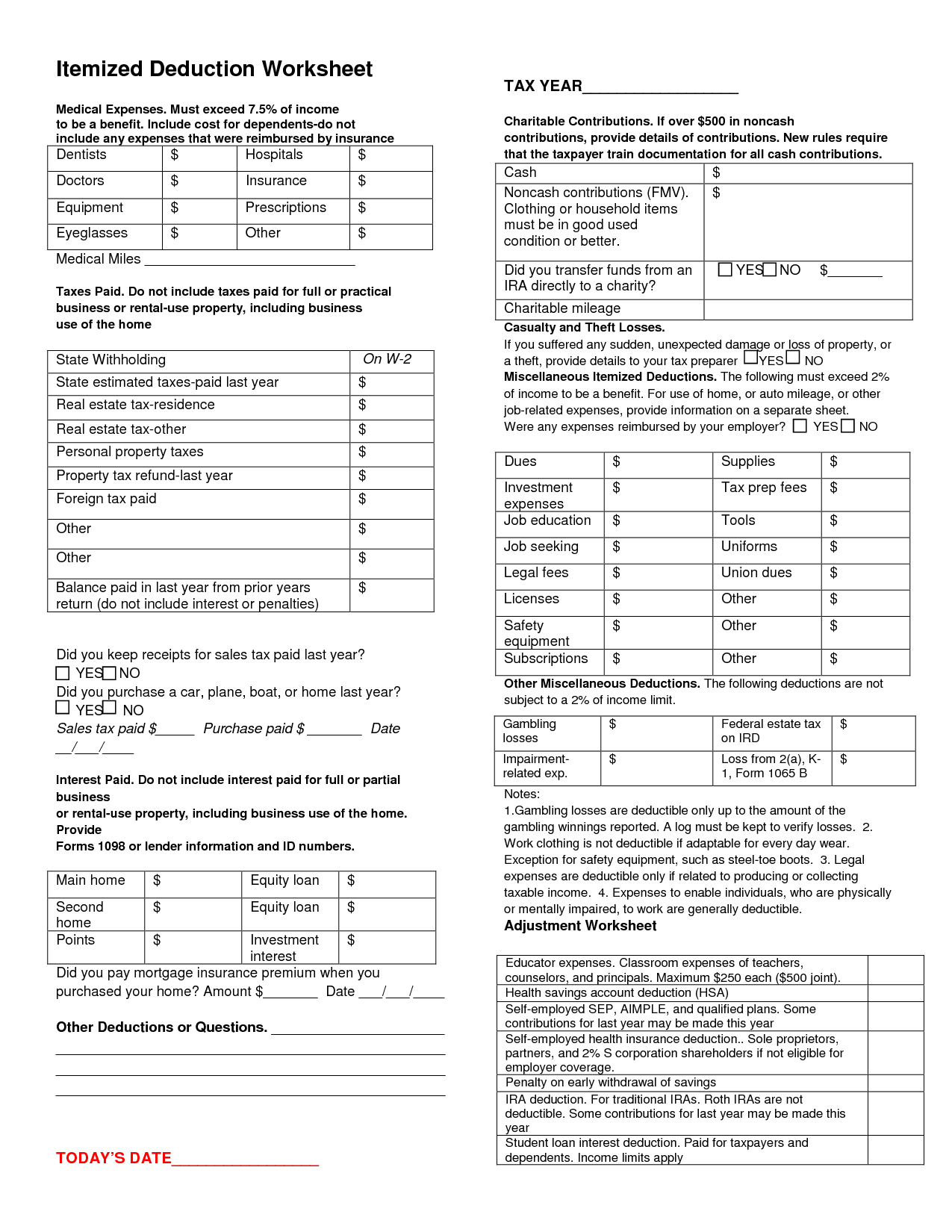

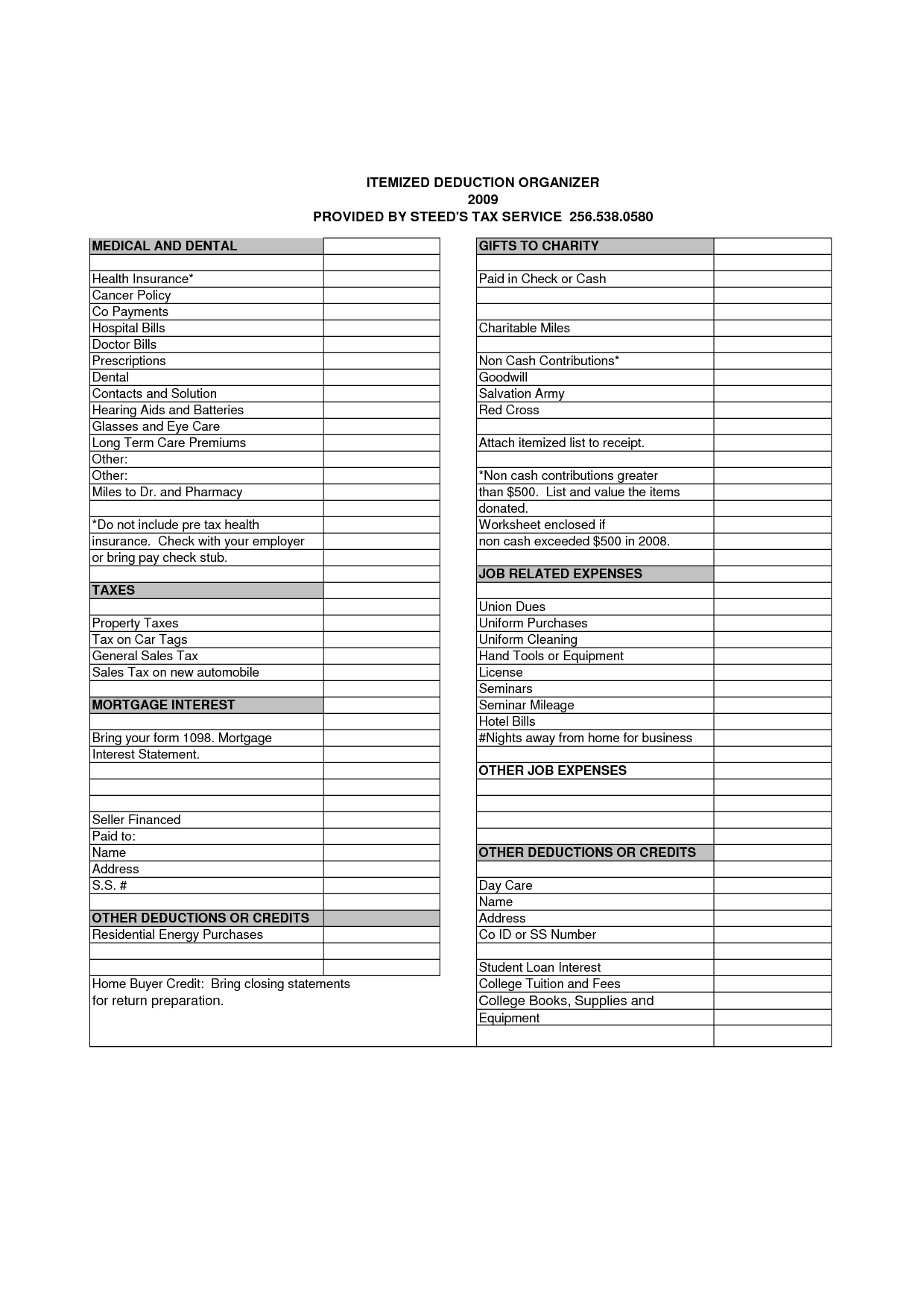

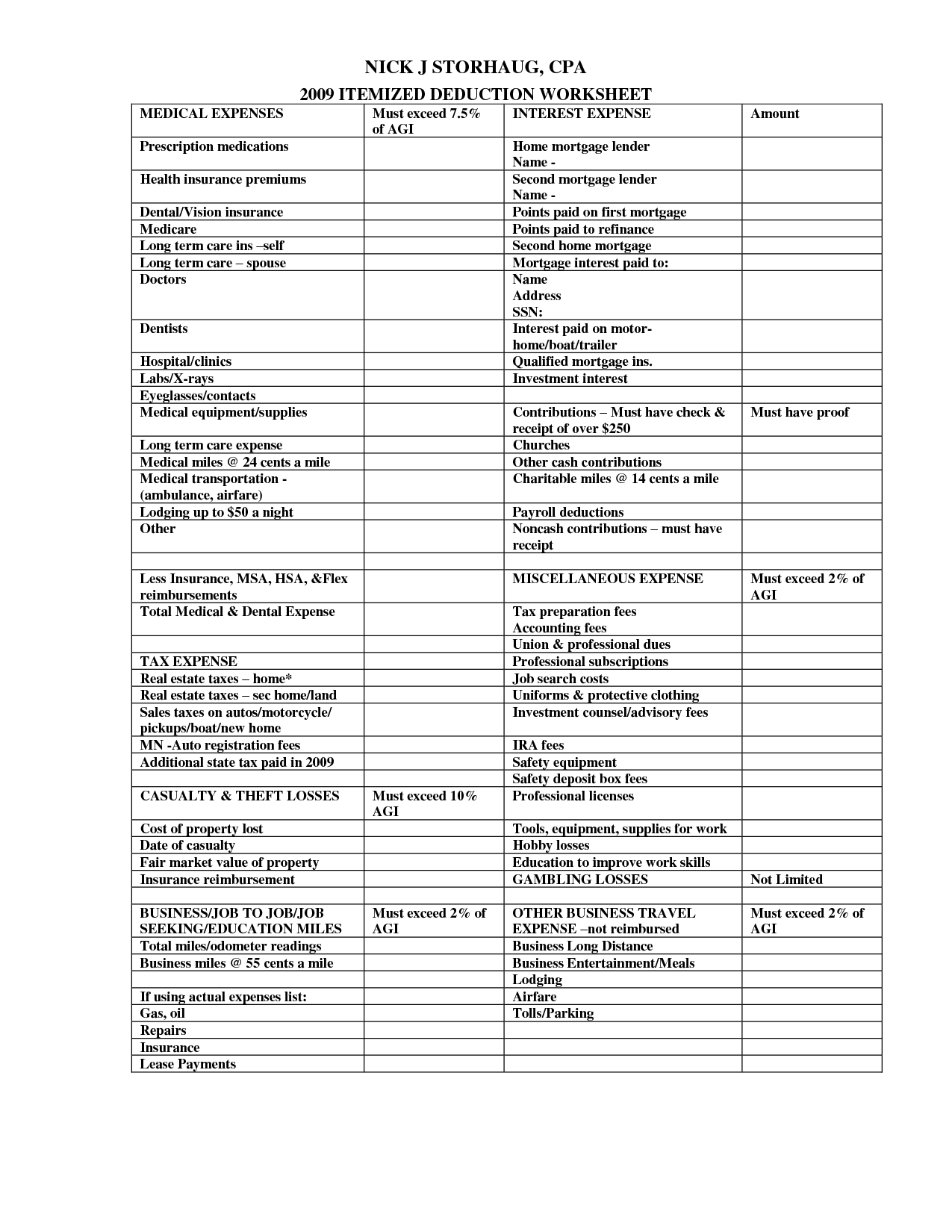

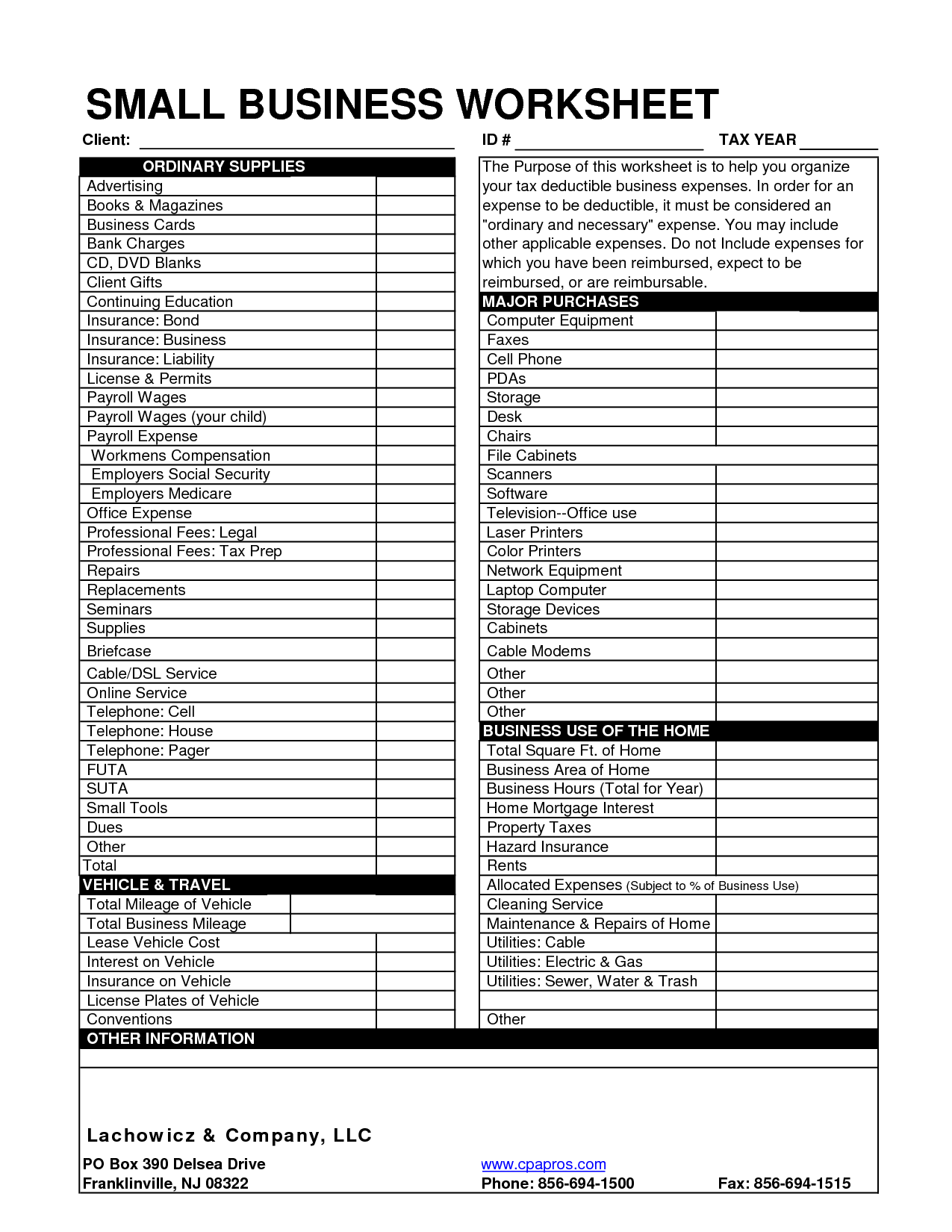

Self Employment Printable Small Business Tax Deductions Worksheet

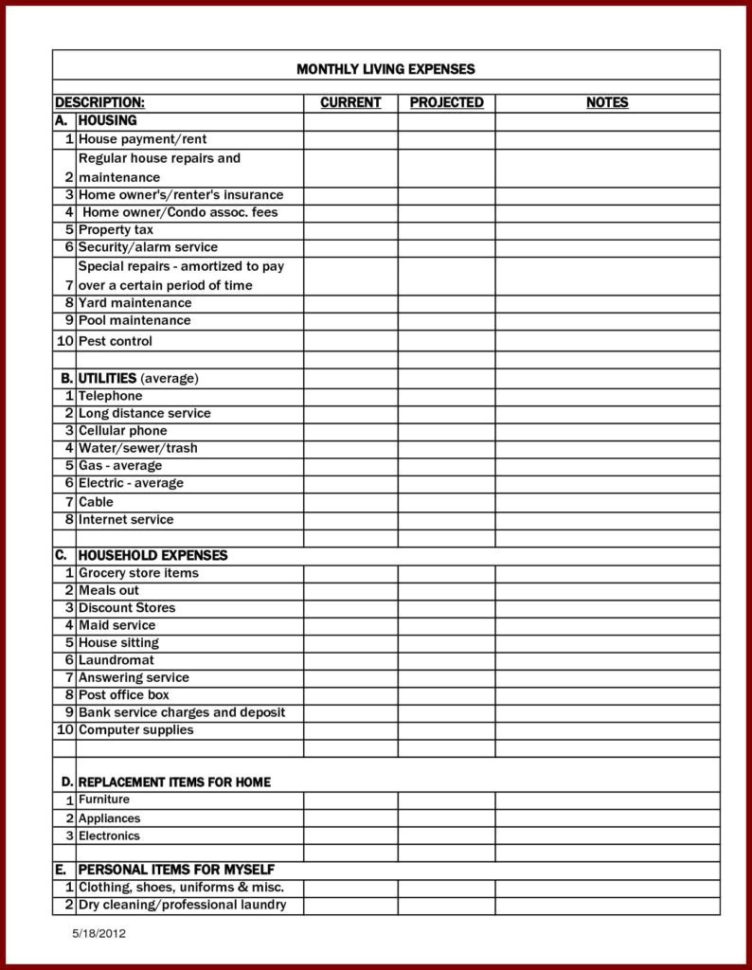

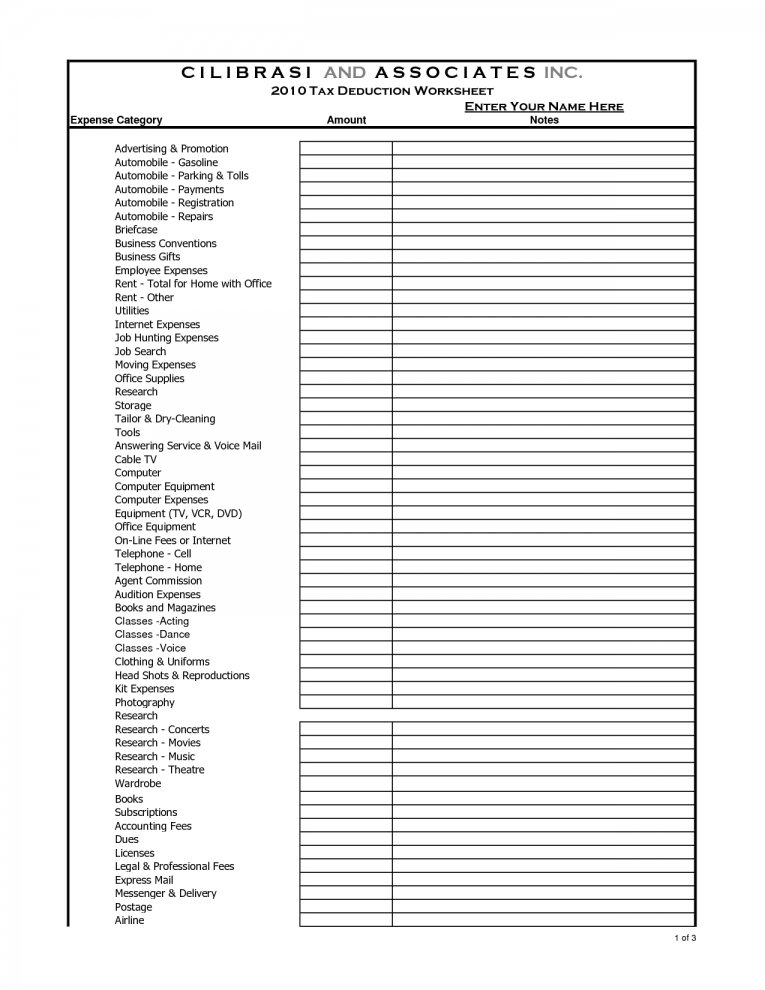

Self Employment Printable Small Business Tax Deductions Worksheet - Web deductible expenses are those that are seen as “ordinary and necessary” for conducting business. Web small business forms and publications. Use this form to figure your qualified business income deduction. The business standard mileage rate from july 1, 2022, to december 31, 2022,. Web up to 24% cash back the legal structure of the business and other factors such as allowable business expenses and special deductions will all be considered when determining the tax. Web printable self employed tax deductions worksheet combines ease of use, affordability and security in one online tool, all without forcing extra ddd on you. Web below is a list of items we will need before we can prepare your taxes: These expenses can range from advertising to utilities and. Web in this guide to small business tax deductions, we’ll tell you which deductions are available, note important changes from last year, and identify potential. Web rose tax & financial self employed worksheet tutorial.

Web reimbursements for business expenses. 12.4% for social security and 2.9% for. On this form, you record all your income and. Web up to 24% cash back the legal structure of the business and other factors such as allowable business expenses and special deductions will all be considered when determining the tax. Web below is a list of items we will need before we can prepare your taxes: Web in this guide to small business tax deductions, we’ll tell you which deductions are available, note important changes from last year, and identify potential. The business standard mileage rate from july 1, 2022, to december 31, 2022,. Web printable self employed tax deductions worksheet combines ease of use, affordability and security in one online tool, all without forcing extra ddd on you. These expenses can range from advertising to utilities and. Web tax year 2022 small business checklist section a identification client(s) who actually operate business name of business (if any).

Use this form to figure your qualified business income deduction. Web deductible expenses are those that are seen as “ordinary and necessary” for conducting business. Web in this guide to small business tax deductions, we’ll tell you which deductions are available, note important changes from last year, and identify potential. On this form, you record all your income and. Web the business standard mileage rate from january 1, 2022, to june 30, 2022, is 58.5 cents per mile. Web rose tax & financial self employed worksheet tutorial. Web reimbursements for business expenses. Completed organizer (see below) prior years tax returns ‐ if you are a first‐time tax client, please provide a. Use separate schedules a, b, c, and/or d, as. Web printable self employed tax deductions worksheet combines ease of use, affordability and security in one online tool, all without forcing extra ddd on you.

20 Self Motivation Worksheet /

You can generally deduct the amount you pay or reimburse employees for business expenses incurred for your business. Try your best to fill this out. Web rose tax & financial self employed worksheet tutorial. You will file schedule c to report your profit to the irs. Web in this guide to small business tax deductions, we’ll tell you which deductions.

Printable Self Employed Tax Deductions Worksheet Studying Worksheets

Use separate schedules a, b, c, and/or d, as. 12.4% for social security and 2.9% for. Web printable self employed tax deductions worksheet combines ease of use, affordability and security in one online tool, all without forcing extra ddd on you. Web small business forms and publications. Web the business standard mileage rate from january 1, 2022, to june 30,.

10 Tax Deduction Worksheet /

Web in this guide to small business tax deductions, we’ll tell you which deductions are available, note important changes from last year, and identify potential. Web rose tax & financial self employed worksheet tutorial. These expenses can range from advertising to utilities and. Use separate schedules a, b, c, and/or d, as. Web printable self employed tax deductions worksheet combines.

Self Employed Tax Deductions Worksheet 2019 Worksheet Resume Examples

Web tax year 2022 small business checklist section a identification client(s) who actually operate business name of business (if any). Web in this guide to small business tax deductions, we’ll tell you which deductions are available, note important changes from last year, and identify potential. On this form, you record all your income and. Try your best to fill this.

Self Employed Tax Deductions Worksheet 2019 Worksheet Resume Examples

Web deductible expenses are those that are seen as “ordinary and necessary” for conducting business. On this form, you record all your income and. You can generally deduct the amount you pay or reimburse employees for business expenses incurred for your business. Web up to 24% cash back the legal structure of the business and other factors such as allowable.

8 Tax Itemized Deduction Worksheet /

You can generally deduct the amount you pay or reimburse employees for business expenses incurred for your business. Web below is a list of items we will need before we can prepare your taxes: These expenses can range from advertising to utilities and. The business standard mileage rate from july 1, 2022, to december 31, 2022,. Web deductible expenses are.

12 Self Employed Tax Worksheet /

On this form, you record all your income and. Web tax year 2022 small business checklist section a identification client(s) who actually operate business name of business (if any). Web reimbursements for business expenses. Web the business standard mileage rate from january 1, 2022, to june 30, 2022, is 58.5 cents per mile. Web deductible expenses are those that are.

8 Best Images of Tax Preparation Organizer Worksheet Individual

Web small business forms and publications. Use separate schedules a, b, c, and/or d, as. Web the business standard mileage rate from january 1, 2022, to june 30, 2022, is 58.5 cents per mile. Web reimbursements for business expenses. On this form, you record all your income and.

Self Employed Tax Deductions Worksheet —

On this form, you record all your income and. Completed organizer (see below) prior years tax returns ‐ if you are a first‐time tax client, please provide a. Web reimbursements for business expenses. Web rose tax & financial self employed worksheet tutorial. Web small business forms and publications.

Small Business Tax Deductions Worksheets

Use this form to figure your qualified business income deduction. Web rose tax & financial self employed worksheet tutorial. You will file schedule c to report your profit to the irs. Completed organizer (see below) prior years tax returns ‐ if you are a first‐time tax client, please provide a. Web small business forms and publications.

Use This Form To Figure Your Qualified Business Income Deduction.

You will file schedule c to report your profit to the irs. Web rose tax & financial self employed worksheet tutorial. These expenses can range from advertising to utilities and. Web deductible expenses are those that are seen as “ordinary and necessary” for conducting business.

Web Below Is A List Of Items We Will Need Before We Can Prepare Your Taxes:

Web printable self employed tax deductions worksheet combines ease of use, affordability and security in one online tool, all without forcing extra ddd on you. Completed organizer (see below) prior years tax returns ‐ if you are a first‐time tax client, please provide a. Web in this guide to small business tax deductions, we’ll tell you which deductions are available, note important changes from last year, and identify potential. You can generally deduct the amount you pay or reimburse employees for business expenses incurred for your business.

Web The Business Standard Mileage Rate From January 1, 2022, To June 30, 2022, Is 58.5 Cents Per Mile.

On this form, you record all your income and. Try your best to fill this out. 12.4% for social security and 2.9% for. Web up to 24% cash back the legal structure of the business and other factors such as allowable business expenses and special deductions will all be considered when determining the tax.

The Business Standard Mileage Rate From July 1, 2022, To December 31, 2022,.

Web tax year 2022 small business checklist section a identification client(s) who actually operate business name of business (if any). Web small business forms and publications. Web reimbursements for business expenses. Use separate schedules a, b, c, and/or d, as.