Printable Form Dol-4N

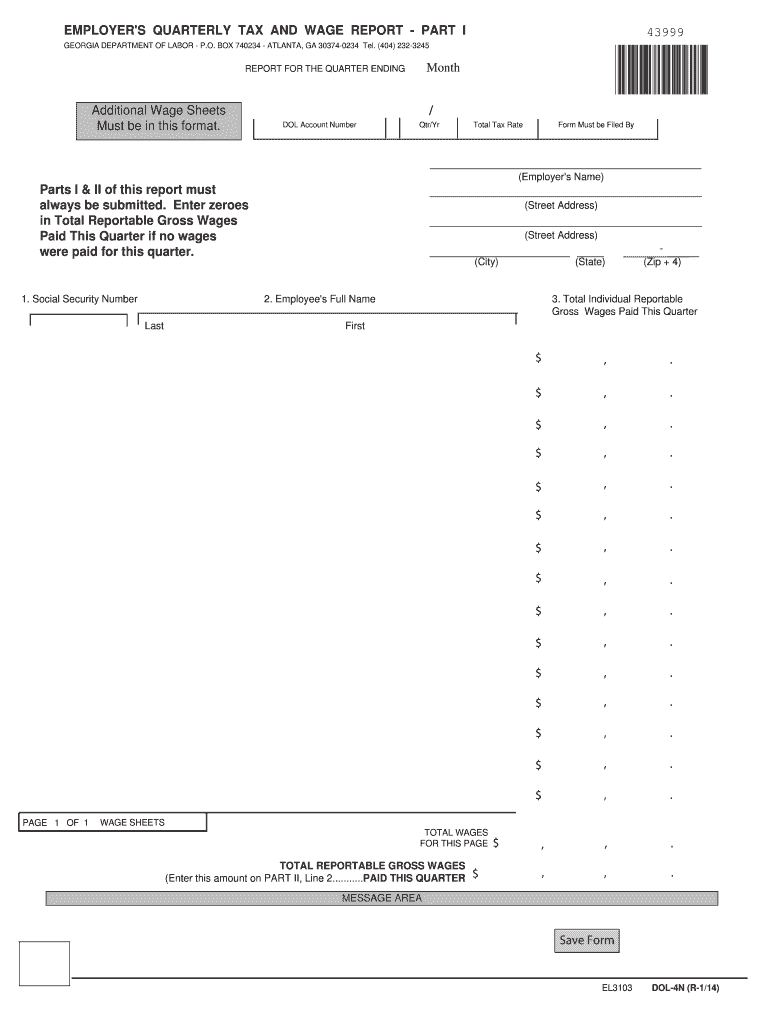

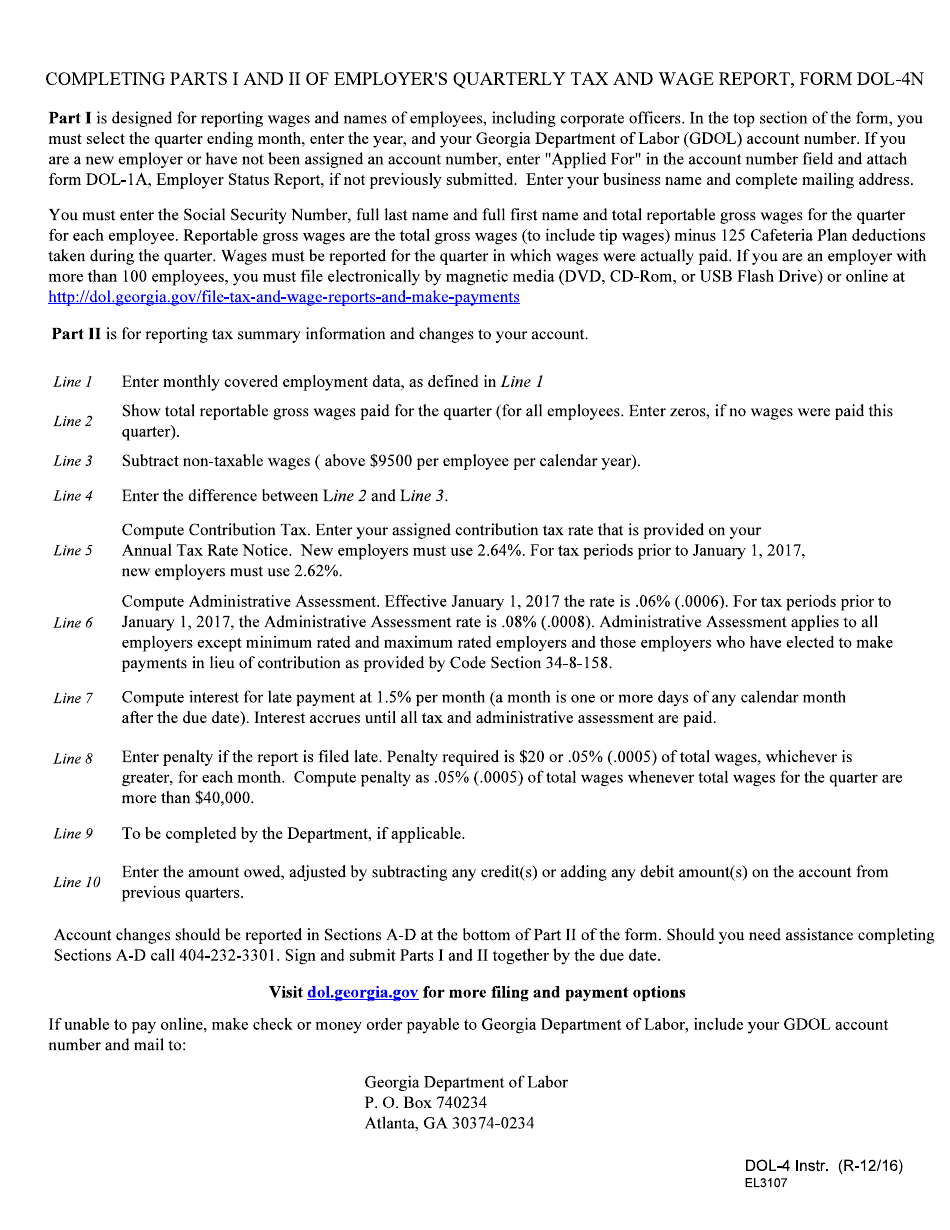

Printable Form Dol-4N - You can upgrade to the latest version of adobe reader from www.adobe.com. Dol account number qtr/yr total tax rate form must be filed by (1st month) (2nd month). (1) correct previously reported wages and/or (2) report wages of individuals who were omitted from the original employer’s quarterly tax and wage. Choose the form you want in the collection of legal forms. Start completing the fillable fields and carefully. Web the form is designed to: Web hey there, @jlsc. Web georgia department of labor requirements for electronic filing of quarterly tax and wage reports employers are required to file their quarterly wage and tax reports. Use get form or simply click on the template preview to open it in the editor. 18 georgia department of labor.

It becoming increasingly more popular amongst services of all sizes. Should you need assistance completing that portion of the form call. You can complete some forms online, while you can download and print all. Web georgia department of labor requirements for electronic filing of quarterly tax and wage reports employers are required to file their quarterly wage and tax reports. Use get form or simply click on the template preview to open it in the editor. 824 georgia tax forms and templates are. They are likewise an easy means to obtain data from your individuals. Dol account number qtr/yr total tax rate form must be filed by (1st month) (2nd month). Web home forms forms these are the most frequently requested u.s. Web the form is designed to:

(1) correct previously reported wages and/or (2) report wages of individuals who were omitted from the original employer’s quarterly tax and wage. Web to view the full contents of this document, you need a later version of the pdf viewer. Serves to catch and record identity authentication, time and date stamp, and ip. July 2, 2021 by tamar. Web home forms forms these are the most frequently requested u.s. 824 georgia tax forms and templates are. They are likewise an easy means to obtain data from your individuals. Transmits the data safely to the servers. Web follow these simple instructions to get dol4n prepared for sending: Use get form or simply click on the template preview to open it in the editor.

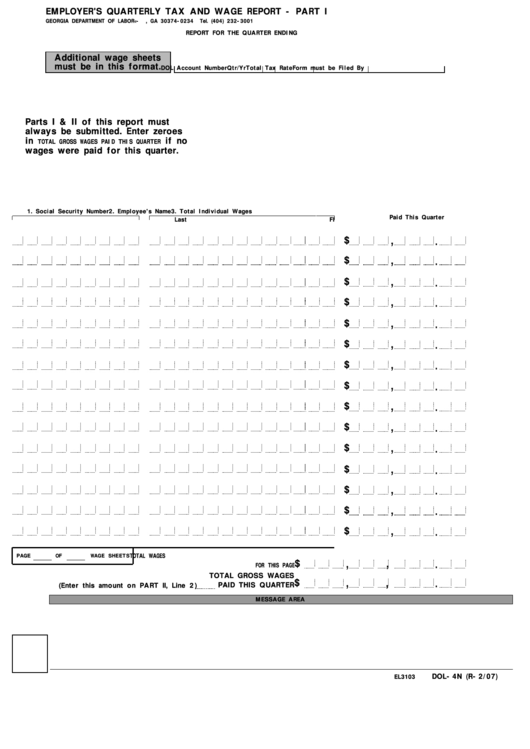

20142023 Form GA DOL4N Fill Online, Printable, Fillable, Blank

You can upgrade to the latest version of adobe reader from www.adobe.com. Use get form or simply click on the template preview to open it in the editor. An upload file formatted to meet dol standards as either a.csv or magnetic media file type. Web hey there, @jlsc. Dol account number qtr/yr total tax rate form must be filed by.

2005 Form GA DOL3C Fill Online, Printable, Fillable, Blank pdfFiller

Web the form is designed to: Web hey there, @jlsc. Web follow these simple instructions to get dol4n prepared for sending: Web home forms forms these are the most frequently requested u.s. It becoming increasingly more popular amongst services of all sizes.

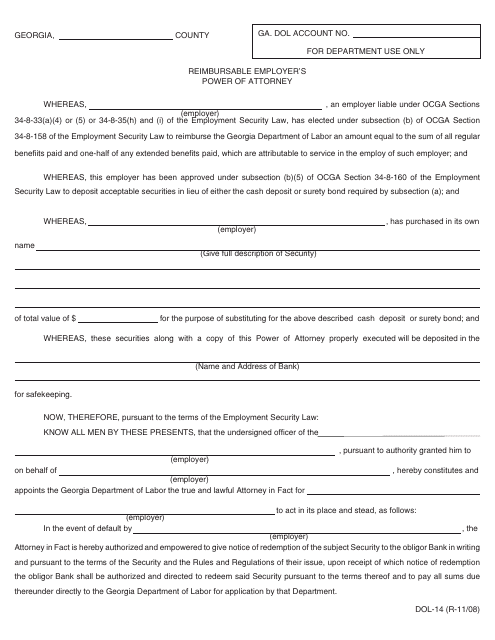

Form DOL14 Download Printable PDF or Fill Online Reimbursable Employer

Filling out the dol4n printable. Open the form in the online editor. You can upgrade to the latest version of adobe reader from www.adobe.com. Dol account number qtr/yr total tax rate form must be filed by (1st month) (2nd month). Web follow these simple instructions to get dol4n prepared for sending:

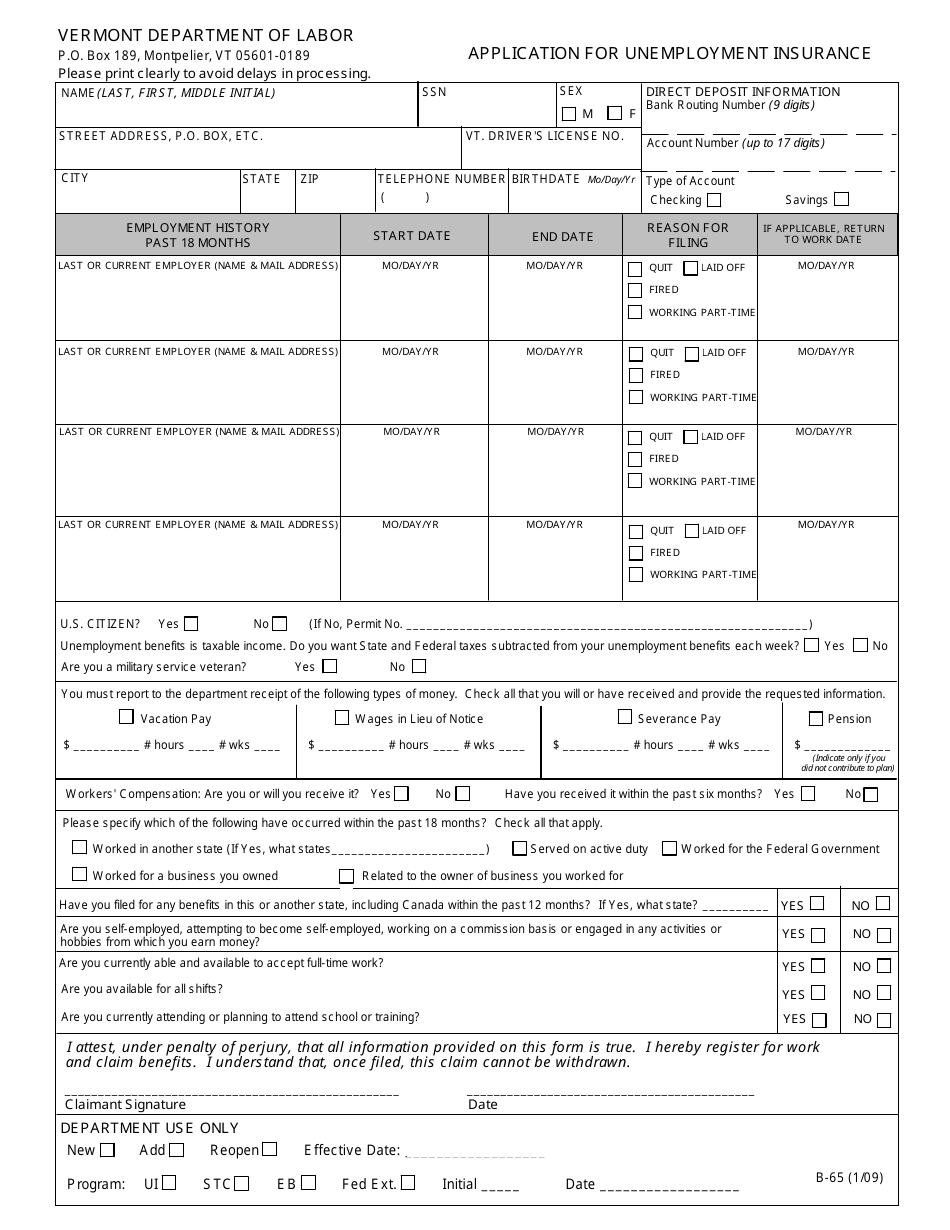

DOL Form B65 Download Printable PDF or Fill Online Application for

Web the form is designed to: An upload file formatted to meet dol standards as either a.csv or magnetic media file type. Web to view the full contents of this document, you need a later version of the pdf viewer. 824 georgia tax forms and templates are. It becoming increasingly more popular amongst services of all sizes.

Form DOL4N Download Fillable PDF or Fill Online Employer's Quarterly

It becoming increasingly more popular amongst services of all sizes. Filling out the dol4n printable. July 2, 2021 by tamar. You can complete some forms online, while you can download and print all. Use get form or simply click on the template preview to open it in the editor.

Form Dol4n Employer'S Quarterly Tax And Wage Report State Of

Web hey there, @jlsc. Web follow these simple instructions to get dol4n prepared for sending: 824 georgia tax forms and templates are. Should you need assistance completing that portion of the form call. Transmits the data safely to the servers.

For paperfiling and documentation purposes a PDF report, Employer's

Web georgia department of labor requirements for electronic filing of quarterly tax and wage reports employers are required to file their quarterly wage and tax reports. Use get form or simply click on the template preview to open it in the editor. Open the form in the online editor. An upload file formatted to meet dol standards as either a.csv.

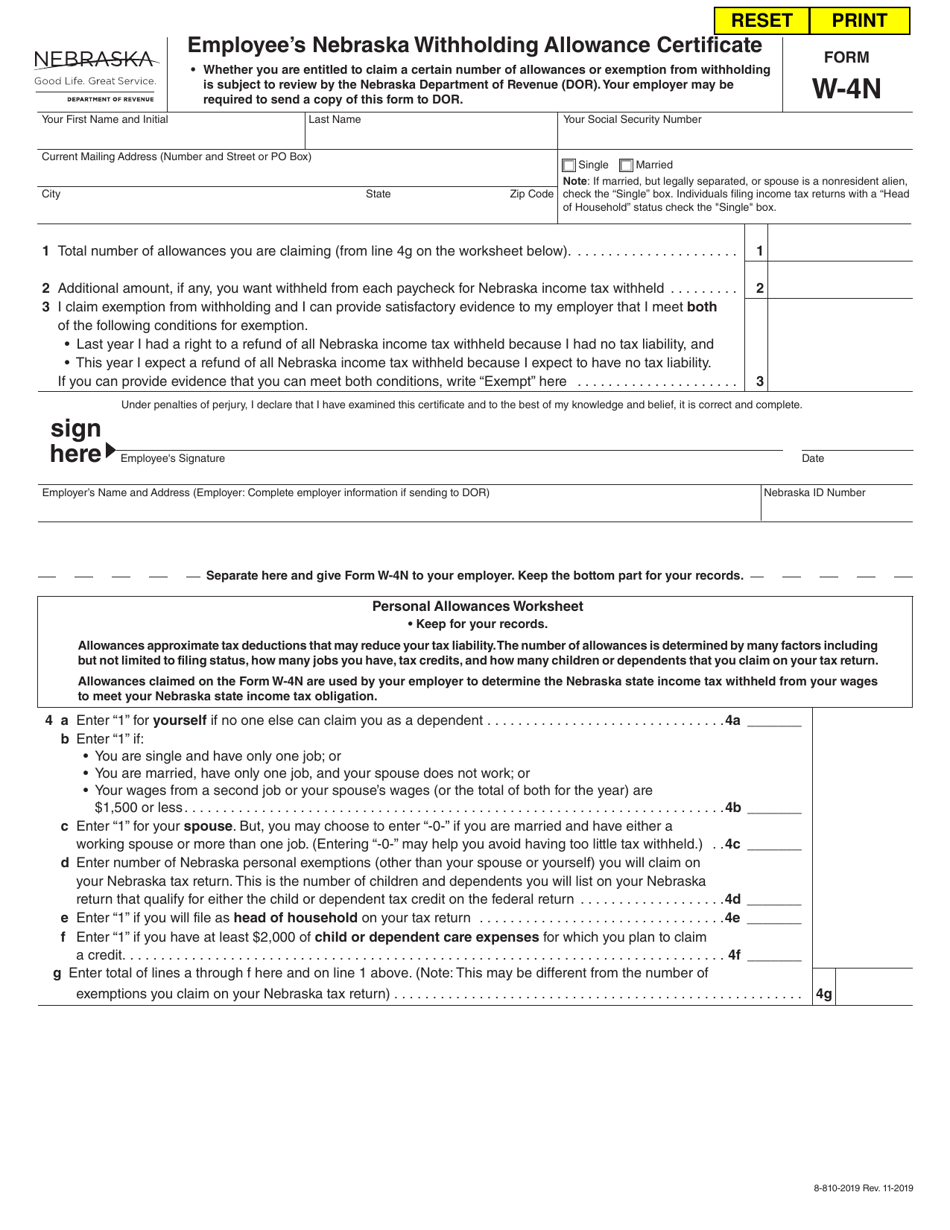

Form W4N Download Fillable PDF or Fill Online Employee's Nebraska

Web to view the full contents of this document, you need a later version of the pdf viewer. Filling out the dol4n printable. Use get form or simply click on the template preview to open it in the editor. Web hey there, @jlsc. Dol account number qtr/yr total tax rate form must be filed by (1st month) (2nd month).

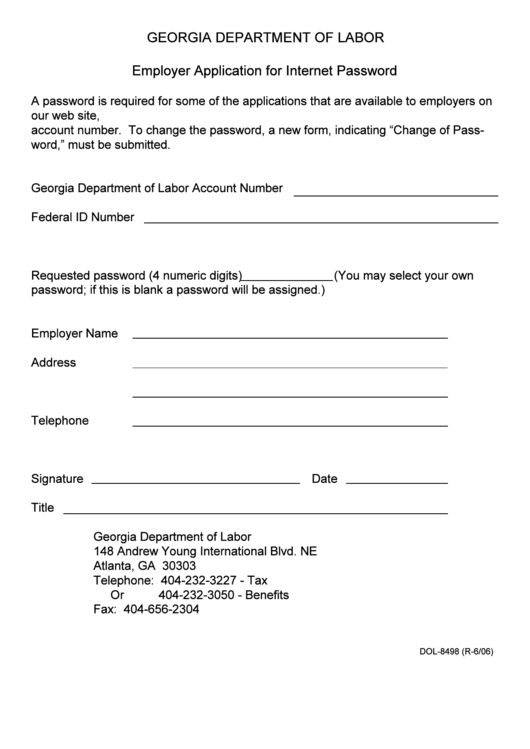

Form Dol8498 Employer Application For Password

Choose the form you want in the collection of legal forms. They are likewise an easy means to obtain data from your individuals. Web georgia department of labor requirements for electronic filing of quarterly tax and wage reports employers are required to file their quarterly wage and tax reports. It becoming increasingly more popular amongst services of all sizes. Transmits.

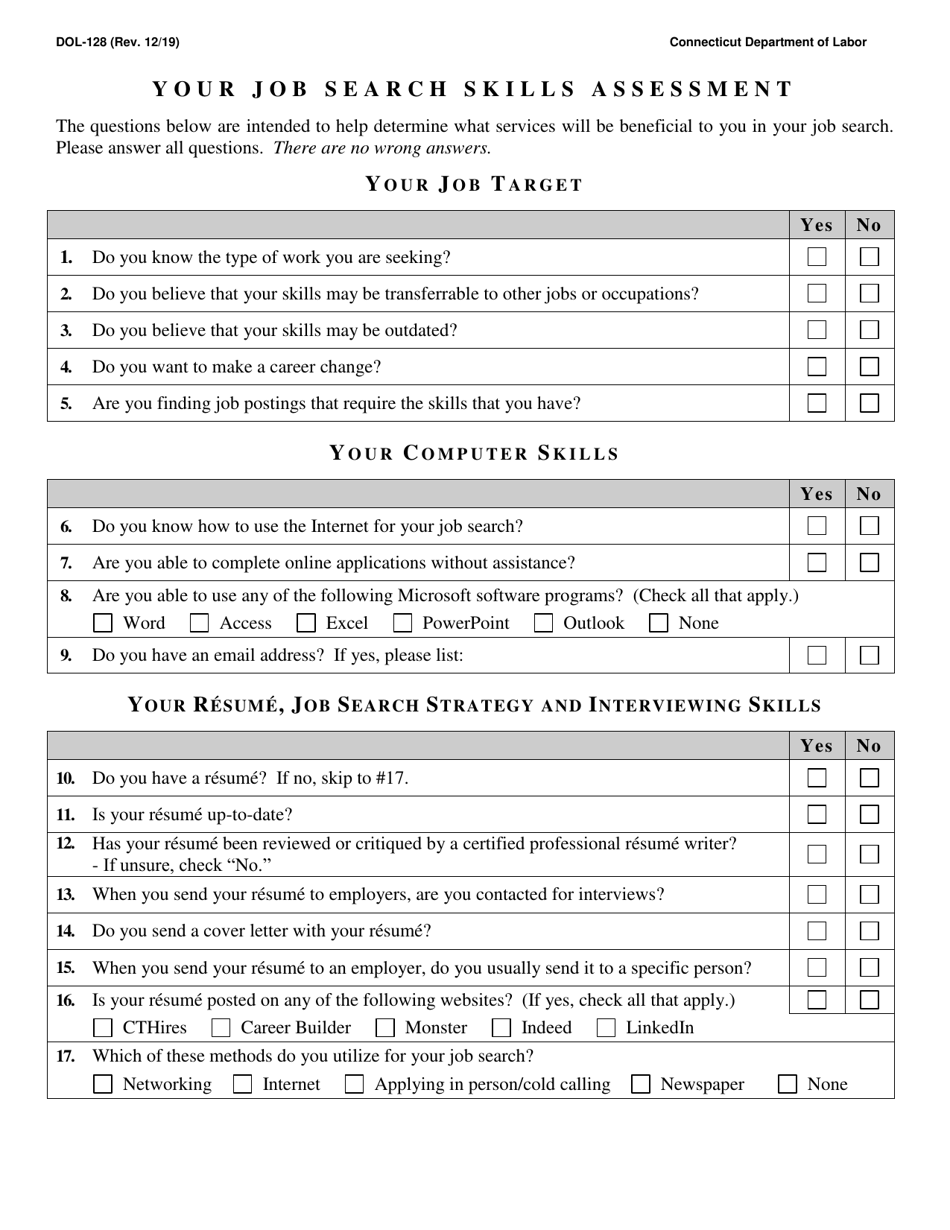

Form DOL128 Download Printable PDF or Fill Online Job Search Skills

Dol account number qtr/yr total tax rate form must be filed by (1st month) (2nd month). 824 georgia tax forms and templates are. July 2, 2021 by tamar. They are likewise an easy means to obtain data from your individuals. Should you need assistance completing that portion of the form call.

Choose The Form You Want In The Collection Of Legal Forms.

Web georgia department of labor requirements for electronic filing of quarterly tax and wage reports employers are required to file their quarterly wage and tax reports. Filling out the dol4n printable. 824 georgia tax forms and templates are. An upload file formatted to meet dol standards as either a.csv or magnetic media file type.

Web Home Forms Forms These Are The Most Frequently Requested U.s.

Web hey there, @jlsc. Should you need assistance completing that portion of the form call. Web follow these simple instructions to get dol4n prepared for sending: They are likewise an easy means to obtain data from your individuals.

You Can Complete Some Forms Online, While You Can Download And Print All.

Year 2000 naswa unemployment insurance code “s”. July 2, 2021 by tamar. Serves to catch and record identity authentication, time and date stamp, and ip. Web the form is designed to:

You Can Upgrade To The Latest Version Of Adobe Reader From Www.adobe.com.

Use get form or simply click on the template preview to open it in the editor. 18 georgia department of labor. Web to view the full contents of this document, you need a later version of the pdf viewer. (1) correct previously reported wages and/or (2) report wages of individuals who were omitted from the original employer’s quarterly tax and wage.

1.jpg)