Printable 941 Forms For 2021

Printable 941 Forms For 2021 - Web 2021 form 941 author: March 2021) employer’s quarterly federal tax return department of the treasury — internal revenue service 950121 omb no. July 2021) employer identification number (ein) department of the treasury — internal revenue service — name (not your trade name) trade name (if any) address The form is optional and uses the same schedules, instructions, and attachments as the regular 1040. Employer s quarterly federal tax return created date: Web report for this quarter of 2021 (check one.) 1: Read the separate instructions before you complete form 941. Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Web form 941 for 2021:

Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Read the separate instructions before you complete form 941. Web the irs has released a new tax filing form for people 65 and older. A form 941 is a tax form used by employers to report their quarterly federal tax liability. However, you will need to file a separate form 941 for each quarter. For instructions and the latest information. Employer s quarterly federal tax return created date: Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. Web form 941 employer's quarterly federal tax return. Adjusted employer’s quarterly federal tax return or claim for refund (rev.

For instructions and the latest information. Web the employer must withhold and pay the total deferred employee share of social security tax ratably from wages paid to the employee between january 1, 2021, and december 31, 2021. Employer s quarterly federal tax return created date: Type or print within the boxes. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Web report for this quarter of 2021 (check one.) 1: Web 01 fill and edit template 02 sign it online 03 export or print immediately can i still fill out form 941 for 2021? July 2021) employer identification number (ein) department of the treasury — internal revenue service — name (not your trade name) trade name (if any) address However, you will need to file a separate form 941 for each quarter.

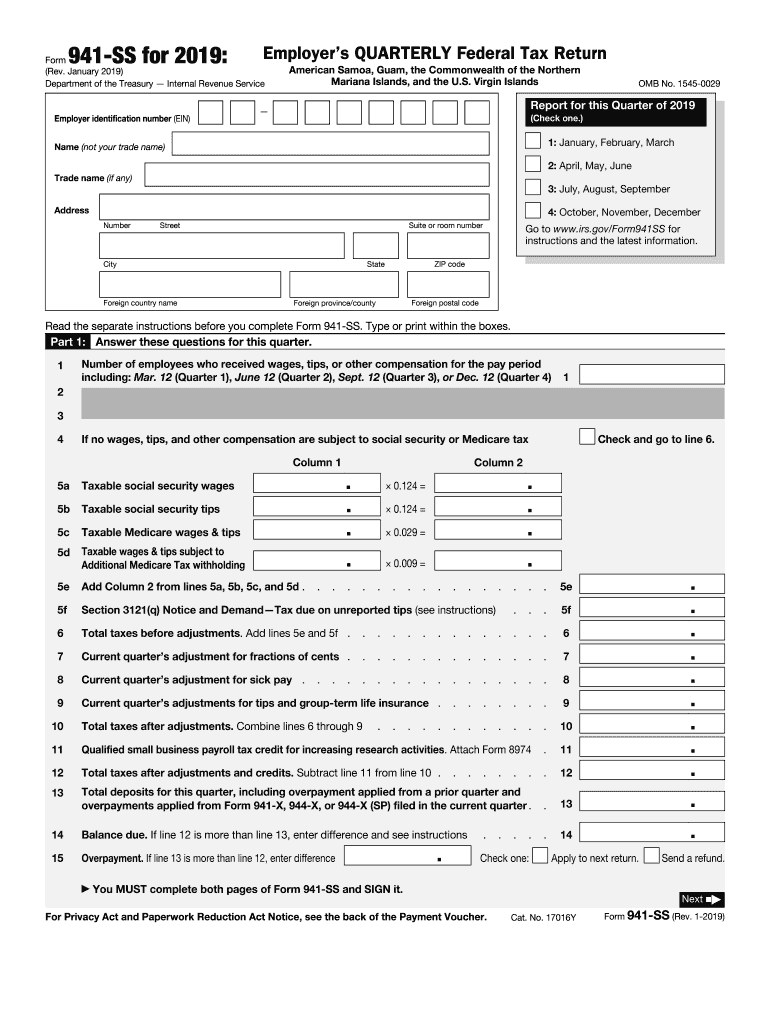

2019 941 Form Fill Out and Sign Printable PDF Template signNow

It has bigger print, less shading, and features like a standard deduction chart. Web the employer must withhold and pay the total deferred employee share of social security tax ratably from wages paid to the employee between january 1, 2021, and december 31, 2021. However, you will need to file a separate form 941 for each quarter. A form 941.

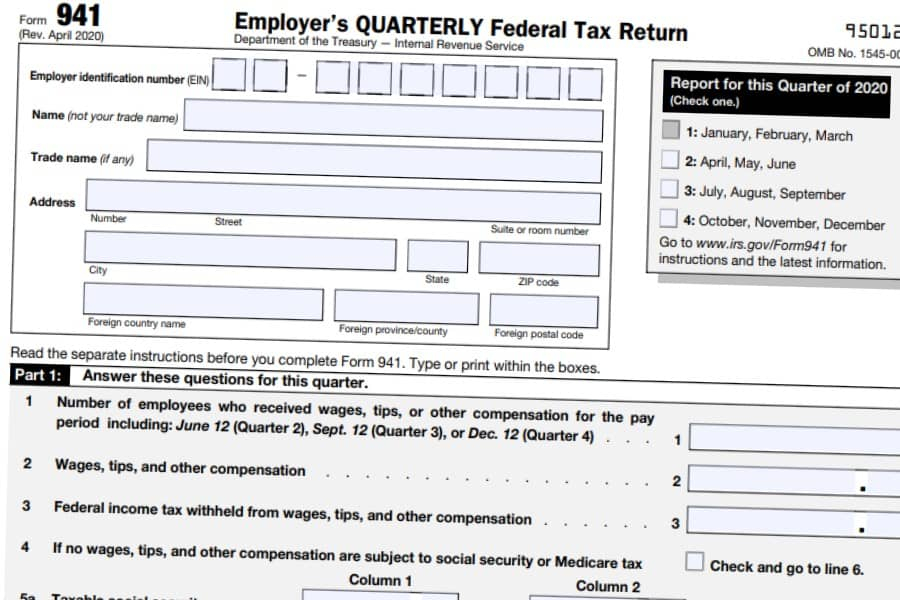

Printable 941 Tax Form 2021 Printable Form 2022

Web form 941 employer's quarterly federal tax return. Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. Web 01 fill and edit template 02 sign it online 03 export or print immediately can i still fill out form 941 for 2021? Web form 941 for 2021: Web information.

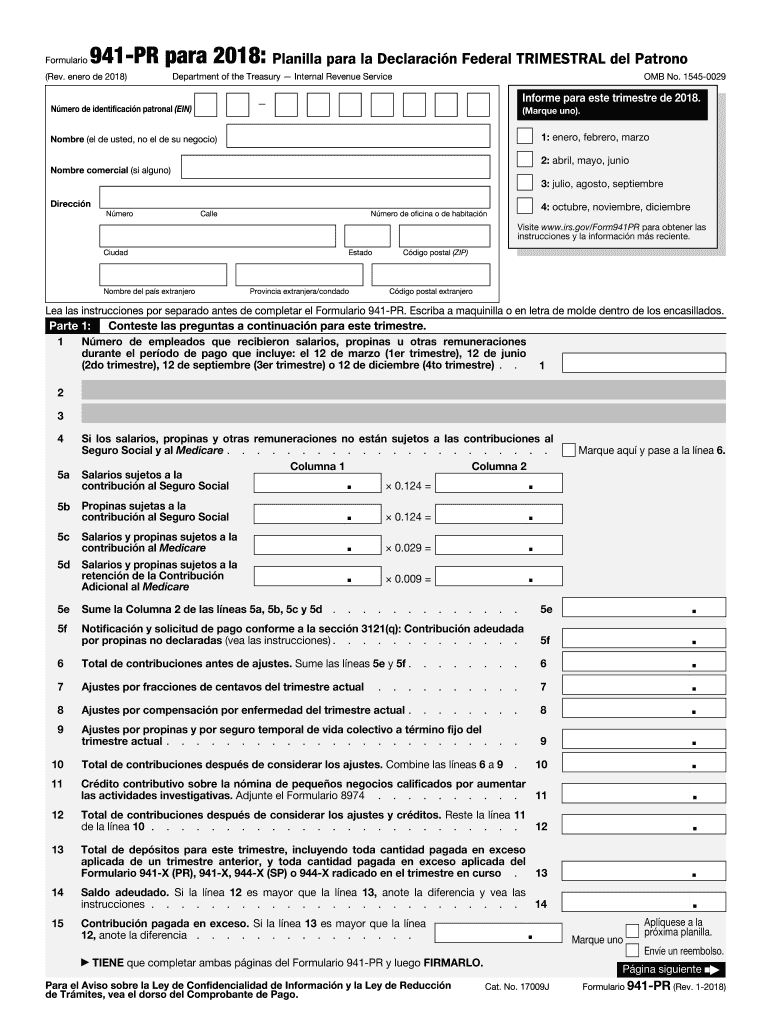

941 Pr 2019 Fill Out and Sign Printable PDF Template signNow

A form 941 is a tax form used by employers to report their quarterly federal tax liability. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. The form is optional and uses the same schedules, instructions, and attachments as the regular 1040. Web the employer must withhold and.

941 Form 2021 941 Forms

However, you will need to file a separate form 941 for each quarter. July 2021) employer identification number (ein) department of the treasury — internal revenue service — name (not your trade name) trade name (if any) address It has bigger print, less shading, and features like a standard deduction chart. Adjusted employer’s quarterly federal tax return or claim for.

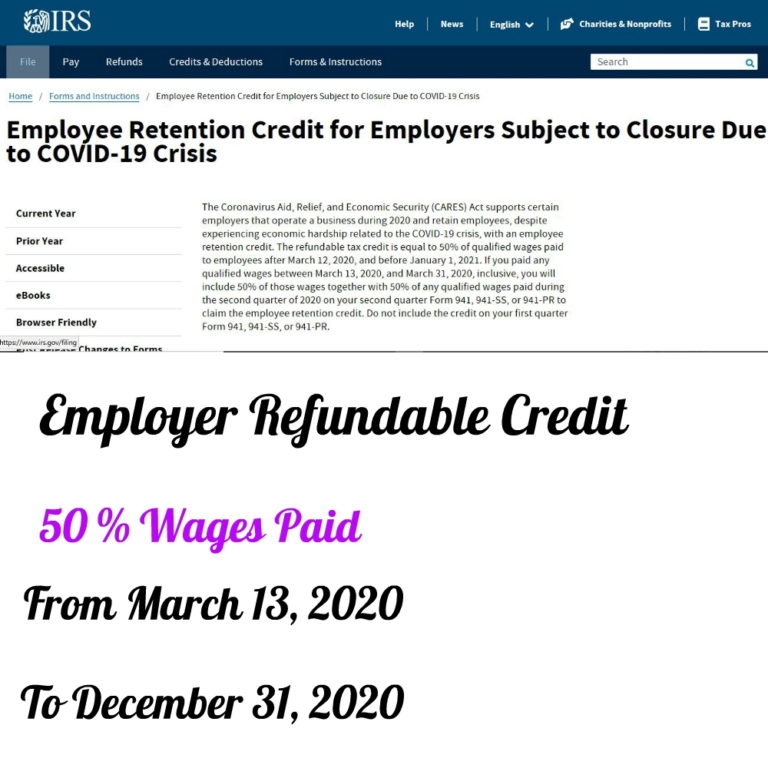

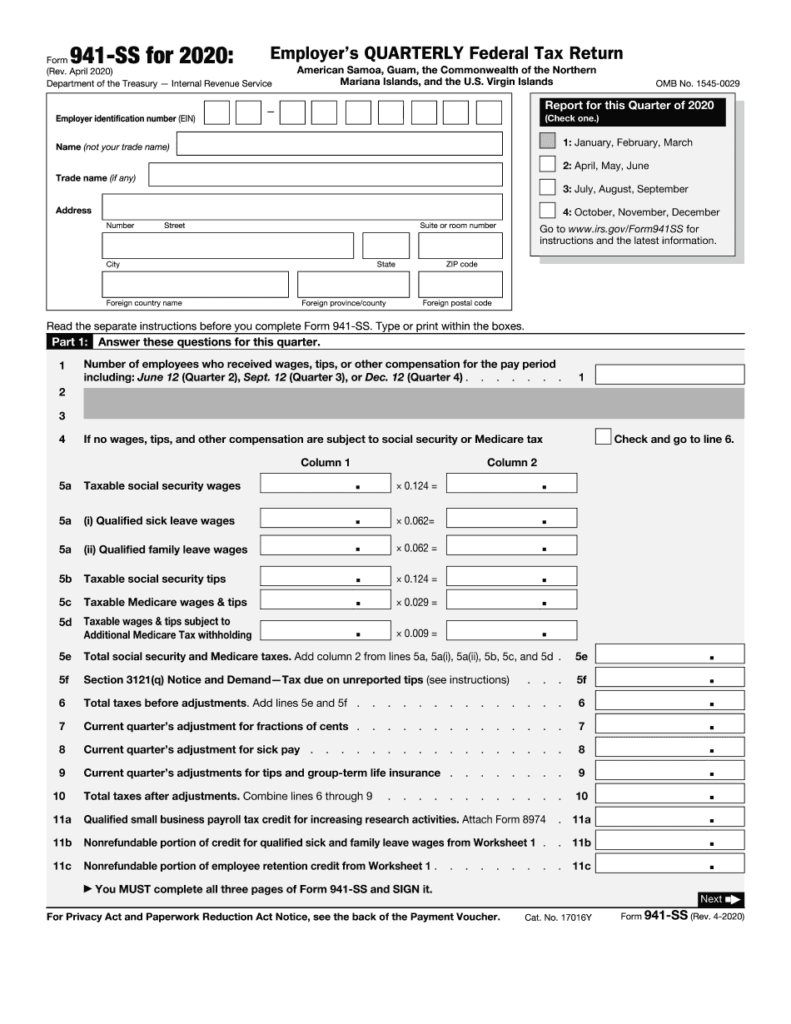

2020 Form 941 Employee Retention Credit for Employers subject to

Web 2021 form 941 author: You can still fill out form 941 for tax year 2021. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax. July 2021) employer identification number (ein) department of the treasury — internal revenue service — name (not.

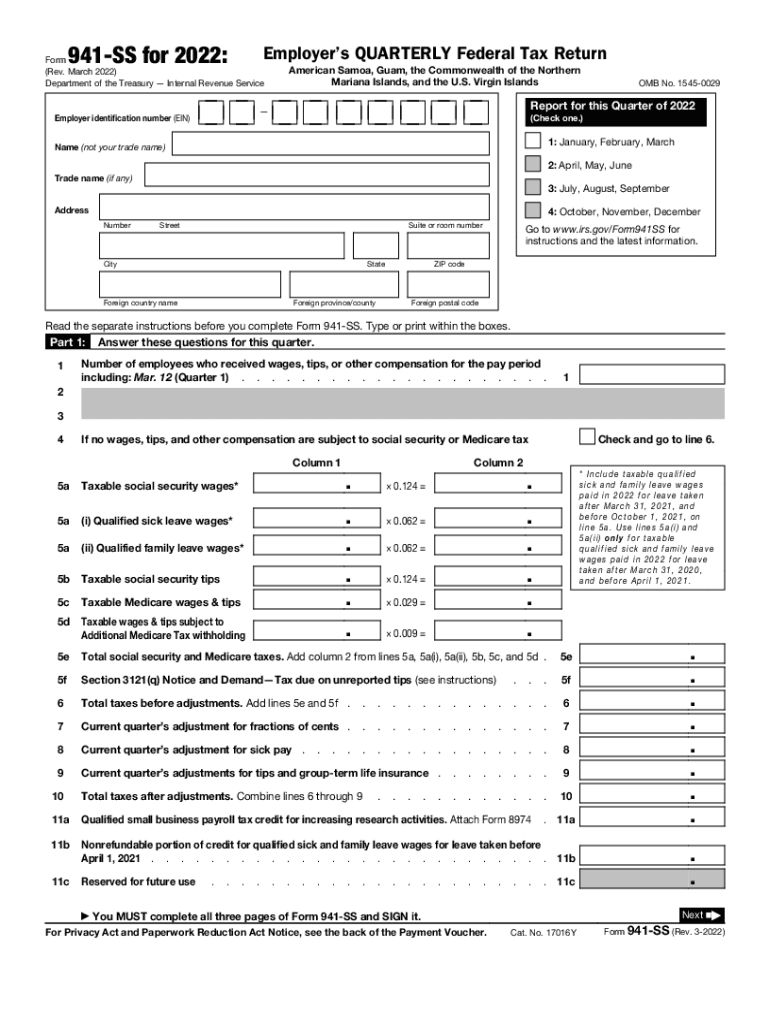

2022 Form IRS 941SS Fill Online, Printable, Fillable, Blank pdfFiller

Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. Web form 941 employer's quarterly federal tax return. If necessary, the employer may make arrangements to otherwise collect the total deferred taxes from the employee. Type or print within the boxes. July 2021) employer identification number (ein) department of.

Printable 941 Form 2021 Printable Form 2022

Web the employer must withhold and pay the total deferred employee share of social security tax ratably from wages paid to the employee between january 1, 2021, and december 31, 2021. Web the irs has released a new tax filing form for people 65 and older. Web report for this quarter of 2021 (check one.) 1: Employers who withhold income.

Printable 941 Tax Form 2021 Printable Form 2022

Web form 941 employer's quarterly federal tax return. The form is optional and uses the same schedules, instructions, and attachments as the regular 1040. You can still fill out form 941 for tax year 2021. Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. If necessary, the employer.

IL DoR IL941X 2021 Fill out Tax Template Online US Legal Forms

Employer s quarterly federal tax return created date: A form 941 is a tax form used by employers to report their quarterly federal tax liability. Read the separate instructions before you complete form 941. Web report for this quarter of 2021 (check one.) 1: Web the irs has released a new tax filing form for people 65 and older.

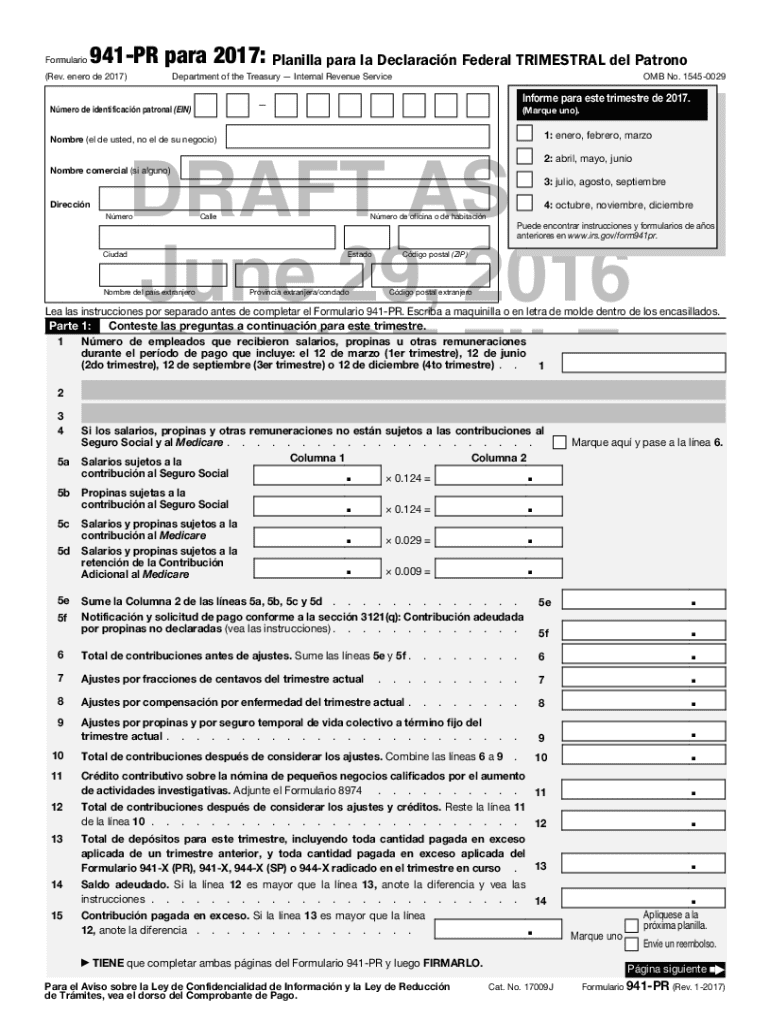

Form 941 PR Rev January Employer's Quarterly Federal Tax Return Puerto

A form 941 is a tax form used by employers to report their quarterly federal tax liability. It has bigger print, less shading, and features like a standard deduction chart. Adjusted employer’s quarterly federal tax return or claim for refund (rev. If necessary, the employer may make arrangements to otherwise collect the total deferred taxes from the employee. Web the.

It Has Bigger Print, Less Shading, And Features Like A Standard Deduction Chart.

Web 01 fill and edit template 02 sign it online 03 export or print immediately can i still fill out form 941 for 2021? July 2021) employer identification number (ein) department of the treasury — internal revenue service — name (not your trade name) trade name (if any) address Web 2021 form 941 author: Web the irs has released a new tax filing form for people 65 and older.

If Necessary, The Employer May Make Arrangements To Otherwise Collect The Total Deferred Taxes From The Employee.

A form 941 is a tax form used by employers to report their quarterly federal tax liability. March 2021) employer’s quarterly federal tax return department of the treasury — internal revenue service 950121 omb no. Read the separate instructions before you complete form 941. Web the employer must withhold and pay the total deferred employee share of social security tax ratably from wages paid to the employee between january 1, 2021, and december 31, 2021.

Adjusted Employer’s Quarterly Federal Tax Return Or Claim For Refund (Rev.

Web form 941 employer's quarterly federal tax return. However, you will need to file a separate form 941 for each quarter. For instructions and the latest information. The form is optional and uses the same schedules, instructions, and attachments as the regular 1040.

Web Information About Form 941, Employer's Quarterly Federal Tax Return, Including Recent Updates, Related Forms, And Instructions On How To File.

You can still fill out form 941 for tax year 2021. Employer s quarterly federal tax return created date: Type or print within the boxes. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax.