Printable 1099 Form For Employees

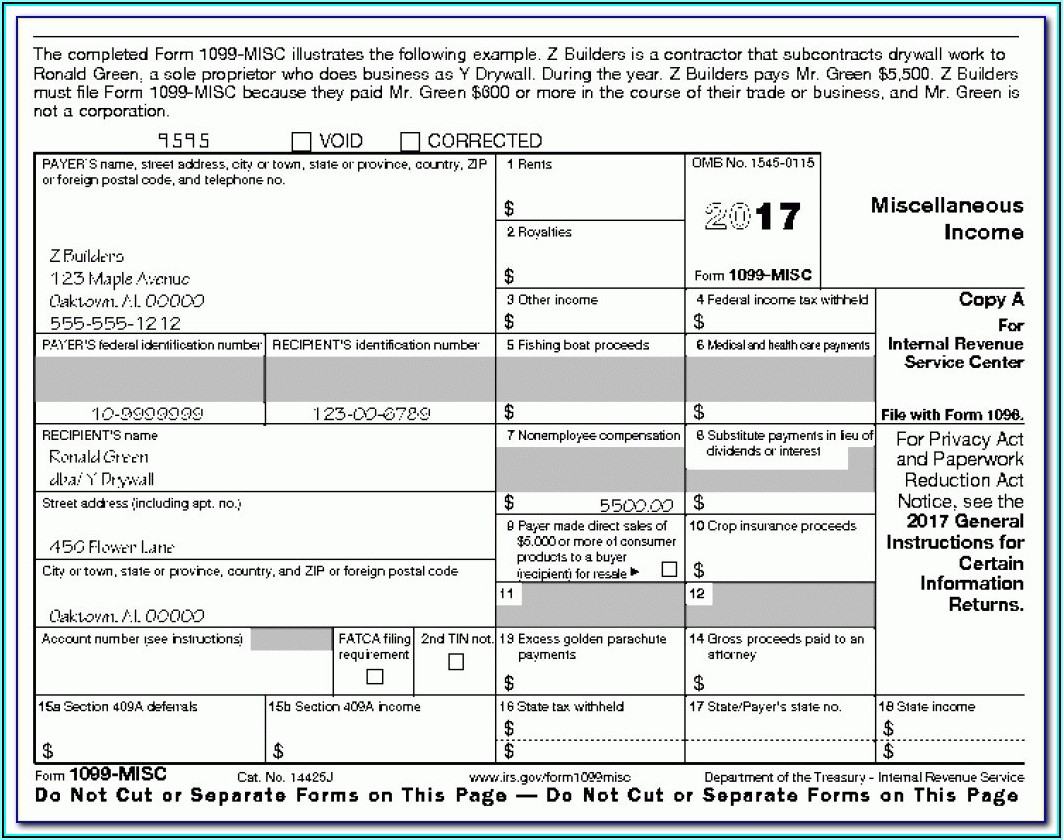

Printable 1099 Form For Employees - If you cannot get this form corrected, attach an explanation to your tax return and report your information correctly. The list of payments that require a business to. Web iris is a free service that lets you: All copy a forms must be printed on this paper. It’s not just a matter of using a color printer loaded with red. These types of income do not include wages, salaries, or tips. Report wages, tips, and other compensation paid to an employee. Report the employee's income and social security taxes withheld and other information. Web businesses and government agencies use 1099 forms to report various types of income to the internal revenue service (irs). If this form is incorrect or has been issued in error, contact the payer.

If this form is incorrect or has been issued in error, contact the payer. Learn about the types of form 1099, what to do if you notice any errors and how to get a copy if you didn’t receive one. Web businesses and government agencies use 1099 forms to report various types of income to the internal revenue service (irs). It’s not just a matter of using a color printer loaded with red. Submit up to 100 records per upload with csv templates. These types of income do not include wages, salaries, or tips. Report wages, tips, and other compensation paid to an employee. Qualified plans and section 403(b) plans. Web iris is a free service that lets you: If you cannot get this form corrected, attach an explanation to your tax return and report your information correctly.

If you cannot get this form corrected, attach an explanation to your tax return and report your information correctly. Web businesses and government agencies use 1099 forms to report various types of income to the internal revenue service (irs). Report wages, tips, and other compensation paid to an employee. If this form is incorrect or has been issued in error, contact the payer. Learn about the types of form 1099, what to do if you notice any errors and how to get a copy if you didn’t receive one. Web iris is a free service that lets you: Report the employee's income and social security taxes withheld and other information. Request automatic extensions to file forms 1099. The list of payments that require a business to. All copy a forms must be printed on this paper.

1099 Form Fillable and Printable IRS PDF

Qualified plans and section 403(b) plans. All copy a forms must be printed on this paper. Learn about the types of form 1099, what to do if you notice any errors and how to get a copy if you didn’t receive one. Request automatic extensions to file forms 1099. Select your product you need to enable javascript to run this.

Blank 1099 Form Blank 1099 Form 2021 eSign Genie

Report wages, tips, and other compensation paid to an employee. Report the employee's income and social security taxes withheld and other information. If this form is incorrect or has been issued in error, contact the payer. Open turbotax sign in why sign in to support? Request automatic extensions to file forms 1099.

Form 1099 Definition

Open all + incorrect or missing form 1099 These types of income do not include wages, salaries, or tips. Report wages, tips, and other compensation paid to an employee. Select your product you need to enable javascript to run this app. Web iris is a free service that lets you:

Where To Get Official 1099 Misc Forms Universal Network

If you cannot get this form corrected, attach an explanation to your tax return and report your information correctly. All copy a forms must be printed on this paper. The list of payments that require a business to. Report the employee's income and social security taxes withheld and other information. Open all + incorrect or missing form 1099

TSP 2020 Form 1099R Statements Should Be Examined Carefully

The list of payments that require a business to. Web businesses and government agencies use 1099 forms to report various types of income to the internal revenue service (irs). Request automatic extensions to file forms 1099. Report wages, tips, and other compensation paid to an employee. These types of income do not include wages, salaries, or tips.

What Is A 1099? Explaining All Form 1099 Types CPA Solutions

Submit up to 100 records per upload with csv templates. Open turbotax sign in why sign in to support? Qualified plans and section 403(b) plans. Report wages, tips, and other compensation paid to an employee. For copies b,c, and 1, however, feel free to use whatever paper you like.

Do I need to file 1099s? Evans Tax Co

These types of income do not include wages, salaries, or tips. The list of payments that require a business to. Open turbotax sign in why sign in to support? Qualified plans and section 403(b) plans. Submit up to 100 records per upload with csv templates.

Free Printable 1099 Misc Forms Free Printable

Request automatic extensions to file forms 1099. Submit up to 100 records per upload with csv templates. Report the employee's income and social security taxes withheld and other information. Learn about the types of form 1099, what to do if you notice any errors and how to get a copy if you didn’t receive one. Web iris is a free.

Printable 1099 Form For Employees Form Resume Examples

The list of payments that require a business to. Open all + incorrect or missing form 1099 Report the employee's income and social security taxes withheld and other information. Web businesses and government agencies use 1099 forms to report various types of income to the internal revenue service (irs). Open turbotax sign in why sign in to support?

1099 Int Tax Form Printable Form Resume Examples AjYdk6w9l0

These types of income do not include wages, salaries, or tips. Open all + incorrect or missing form 1099 It’s not just a matter of using a color printer loaded with red. If this form is incorrect or has been issued in error, contact the payer. If you cannot get this form corrected, attach an explanation to your tax return.

Learn About The Types Of Form 1099, What To Do If You Notice Any Errors And How To Get A Copy If You Didn’t Receive One.

It’s not just a matter of using a color printer loaded with red. Submit up to 100 records per upload with csv templates. For copies b,c, and 1, however, feel free to use whatever paper you like. Web iris is a free service that lets you:

These Types Of Income Do Not Include Wages, Salaries, Or Tips.

The list of payments that require a business to. Report the employee's income and social security taxes withheld and other information. All copy a forms must be printed on this paper. If you cannot get this form corrected, attach an explanation to your tax return and report your information correctly.

Select Your Product You Need To Enable Javascript To Run This App.

Web businesses and government agencies use 1099 forms to report various types of income to the internal revenue service (irs). Qualified plans and section 403(b) plans. Request automatic extensions to file forms 1099. Open turbotax sign in why sign in to support?

If This Form Is Incorrect Or Has Been Issued In Error, Contact The Payer.

Report wages, tips, and other compensation paid to an employee. Open all + incorrect or missing form 1099

:max_bytes(150000):strip_icc()/1099r-eda9fdcb4d82449da27f9f30a318aaa3.jpg)