Nc D-400V Printable Form

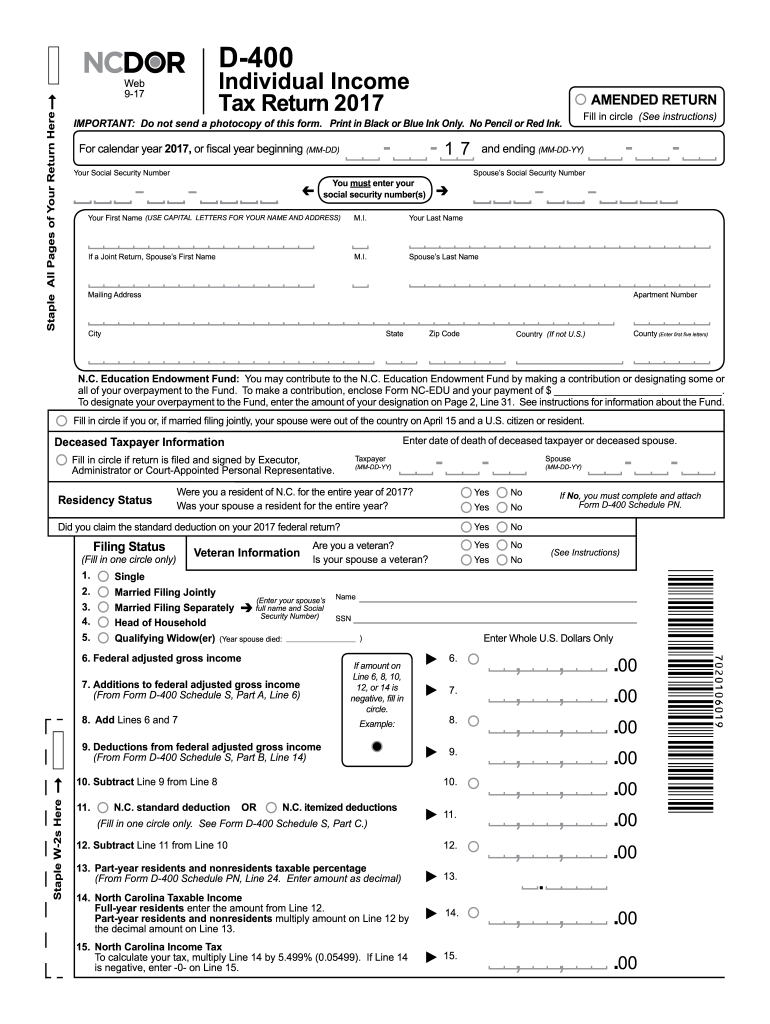

Nc D-400V Printable Form - Web we would like to show you a description here but the site won’t allow us. Web use the create form button located below to generate the printable form. Add lines 6 and 7. (do not send copies of completed worksheets from the instruction booklet or other unnecessary attachments.) • a check or money order payable to the “north carolina department of revenue,” if you. (if itemizing, complete part c of form d. Web the nc d400v template is a form with fillable spaces where you can insert information, i.e., fill it out on the web. Subtract line 9 from line 8. Web use the create form button located below to generate the printable form. Web follow the simple instructions below: Sales and use electronic data interchange (edi) step by step instructions for.

Itemized deductions fill in one circle only. Web we would like to show you a description here but the site won’t allow us. This payment application should be used only for the payment of tax owed on an amended north carolina individual income tax return for tax year 2008 to current tax year. (if itemizing, complete part c of form d. Sales and use electronic data interchange (edi) step by step instructions for. Web follow the simple instructions below: Online tax forms have been created to help people file their taxes, but you want to be sure they meet up with government requirements and irs form specs. Web the nc d400v template is a form with fillable spaces where you can insert information, i.e., fill it out on the web. Subtract line 9 from line 8. Nowadays, most americans prefer to do their own income taxes and, in addition, to fill in papers in electronic format.

Nowadays, most americans prefer to do their own income taxes and, in addition, to fill in papers in electronic format. Web • other required north carolina forms or supporting schedules. Subtract line 9 from line 8. Web follow the simple instructions below: Subtract line 11 from line 10. Sales and use electronic data interchange (edi) step by step instructions for. Web the nc d400v template is a form with fillable spaces where you can insert information, i.e., fill it out on the web. Web use the create form button located below to generate the printable form. Were you a resident of n.c. Add lines 6 and 7.

NC DoR D400 2017 Fill out Tax Template Online US Legal Forms

(if itemizing, complete part c of form d. Subtract line 9 from line 8. Sales and use electronic data interchange (edi) step by step instructions for. Nowadays, most americans prefer to do their own income taxes and, in addition, to fill in papers in electronic format. Web • other required north carolina forms or supporting schedules.

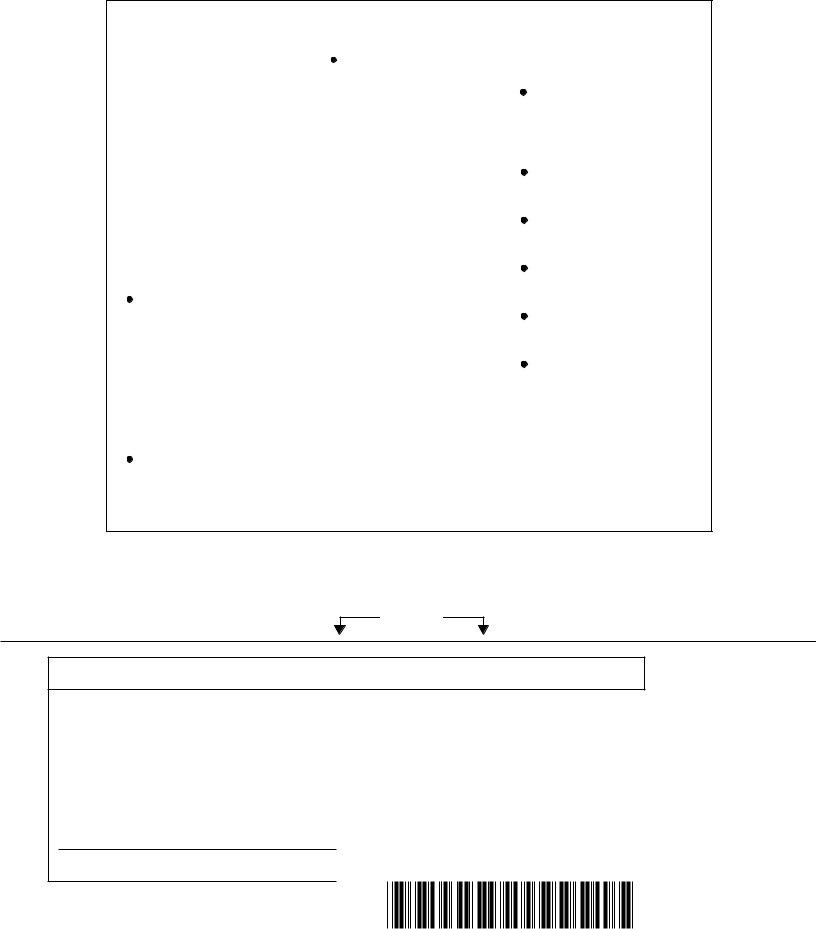

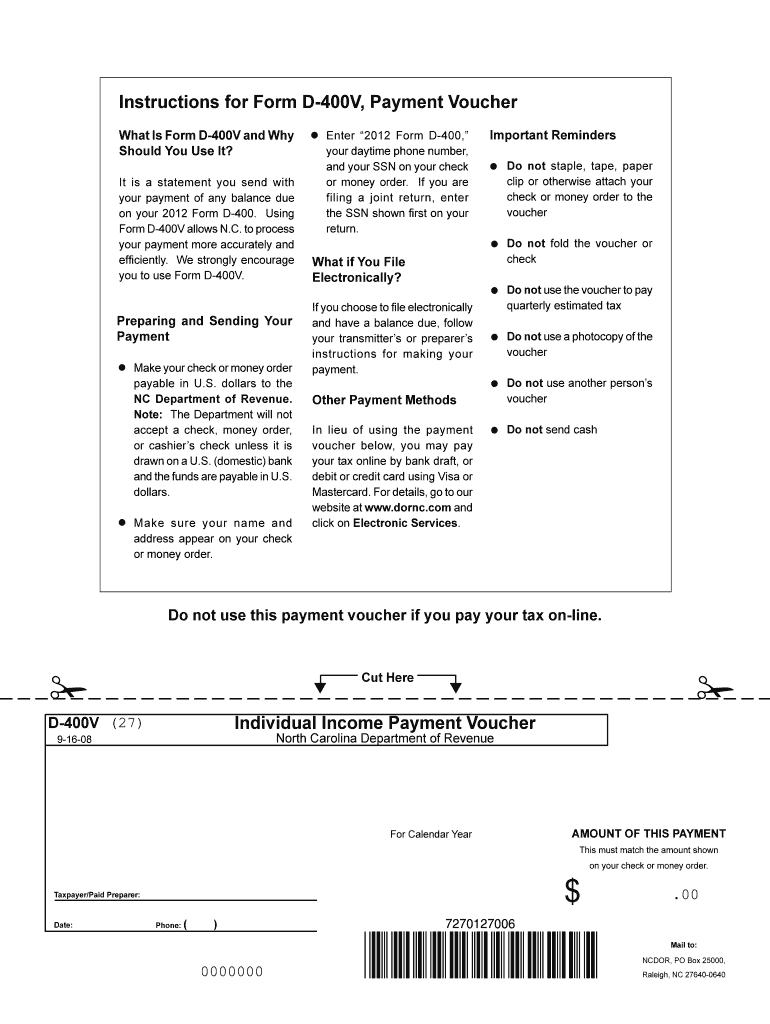

Form D 400V ≡ Fill Out Printable PDF Forms Online

Web • other required north carolina forms or supporting schedules. Web follow the simple instructions below: Web the nc d400v template is a form with fillable spaces where you can insert information, i.e., fill it out on the web. Were you a resident of n.c. Web use the create form button located below to generate the printable form.

NC DoR D400V 20082022 Fill out Tax Template Online US Legal Forms

Online tax forms have been created to help people file their taxes, but you want to be sure they meet up with government requirements and irs form specs. Sales and use electronic data interchange (edi) step by step instructions for. Subtract line 11 from line 10. Web the nc d400v template is a form with fillable spaces where you can.

Form D 400 Individual Tax Return YouTube

(if itemizing, complete part c of form d. Nowadays, most americans prefer to do their own income taxes and, in addition, to fill in papers in electronic format. Online tax forms have been created to help people file their taxes, but you want to be sure they meet up with government requirements and irs form specs. (do not send copies.

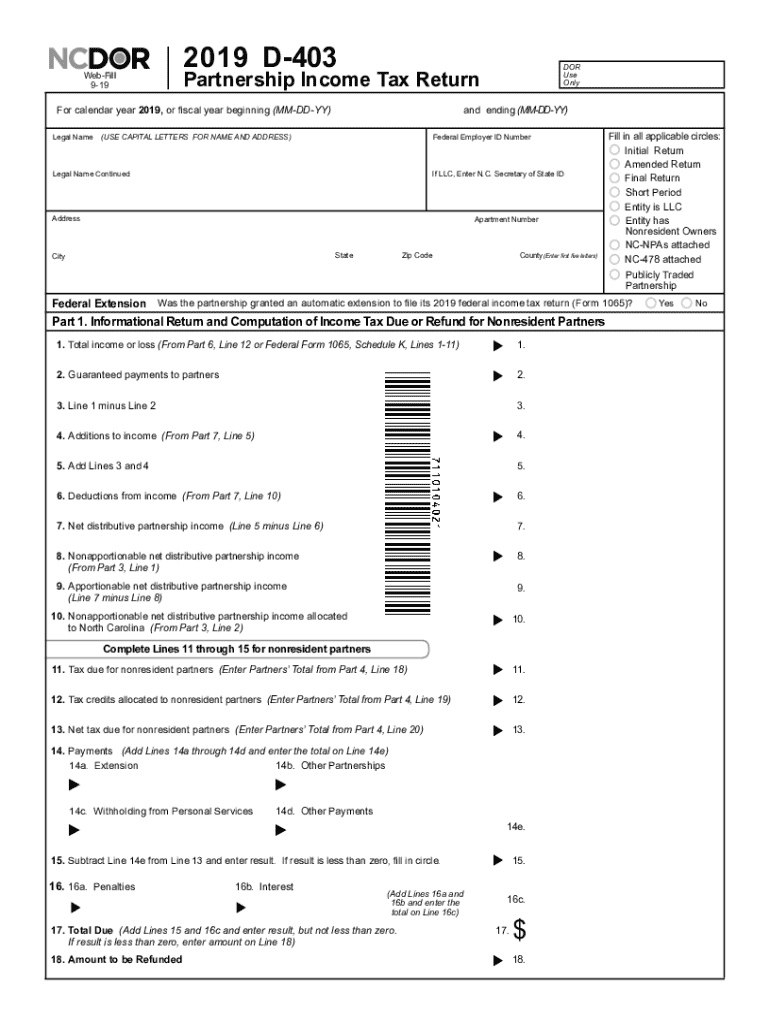

Nc K 1 Instructions Fill Out and Sign Printable PDF Template signNow

Web we would like to show you a description here but the site won’t allow us. Subtract line 9 from line 8. Web • other required north carolina forms or supporting schedules. (if itemizing, complete part c of form d. Web use the create form button located below to generate the printable form.

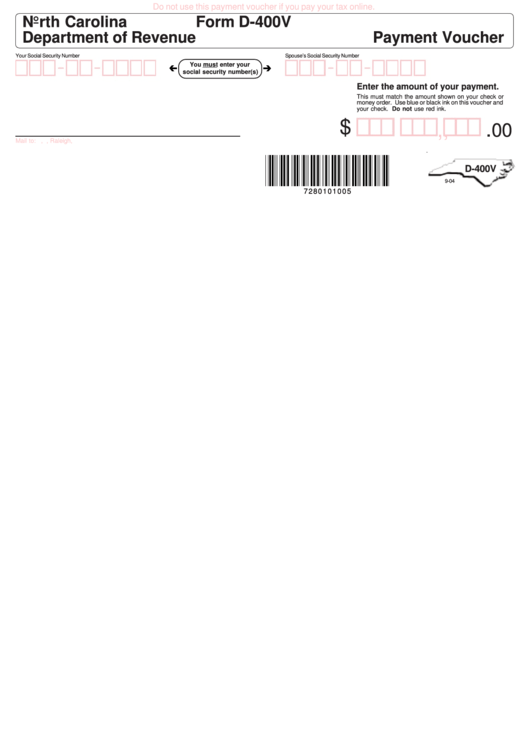

Form D400v Payment Voucher North Carolina Department Of Revenue

Web use the create form button located below to generate the printable form. Subtract line 11 from line 10. (if itemizing, complete part c of form d. Were you a resident of n.c. Add lines 6 and 7.

NC DoR D400TC 2014 Fill out Tax Template Online US Legal Forms

Web • other required north carolina forms or supporting schedules. Web use the create form button located below to generate the printable form. Web we would like to show you a description here but the site won’t allow us. Nowadays, most americans prefer to do their own income taxes and, in addition, to fill in papers in electronic format. Online.

2015 d 400 form Fill out & sign online DocHub

Web • other required north carolina forms or supporting schedules. Itemized deductions fill in one circle only. Web we would like to show you a description here but the site won’t allow us. Nowadays, most americans prefer to do their own income taxes and, in addition, to fill in papers in electronic format. Web use the create form button located.

NC DoR D400TC 2015 Fill out Tax Template Online US Legal Forms

Were you a resident of n.c. Add lines 6 and 7. Web • other required north carolina forms or supporting schedules. Subtract line 9 from line 8. Web the nc d400v template is a form with fillable spaces where you can insert information, i.e., fill it out on the web.

Web The Nc D400V Template Is A Form With Fillable Spaces Where You Can Insert Information, I.e., Fill It Out On The Web.

Sales and use electronic data interchange (edi) step by step instructions for. Subtract line 9 from line 8. Web follow the simple instructions below: Were you a resident of n.c.

Itemized Deductions Fill In One Circle Only.

Web we would like to show you a description here but the site won’t allow us. Web use the create form button located below to generate the printable form. (do not send copies of completed worksheets from the instruction booklet or other unnecessary attachments.) • a check or money order payable to the “north carolina department of revenue,” if you. Nowadays, most americans prefer to do their own income taxes and, in addition, to fill in papers in electronic format.

Online Tax Forms Have Been Created To Help People File Their Taxes, But You Want To Be Sure They Meet Up With Government Requirements And Irs Form Specs.

(if itemizing, complete part c of form d. Web • other required north carolina forms or supporting schedules. Add lines 6 and 7. Web use the create form button located below to generate the printable form.

Subtract Line 11 From Line 10.

This payment application should be used only for the payment of tax owed on an amended north carolina individual income tax return for tax year 2008 to current tax year.