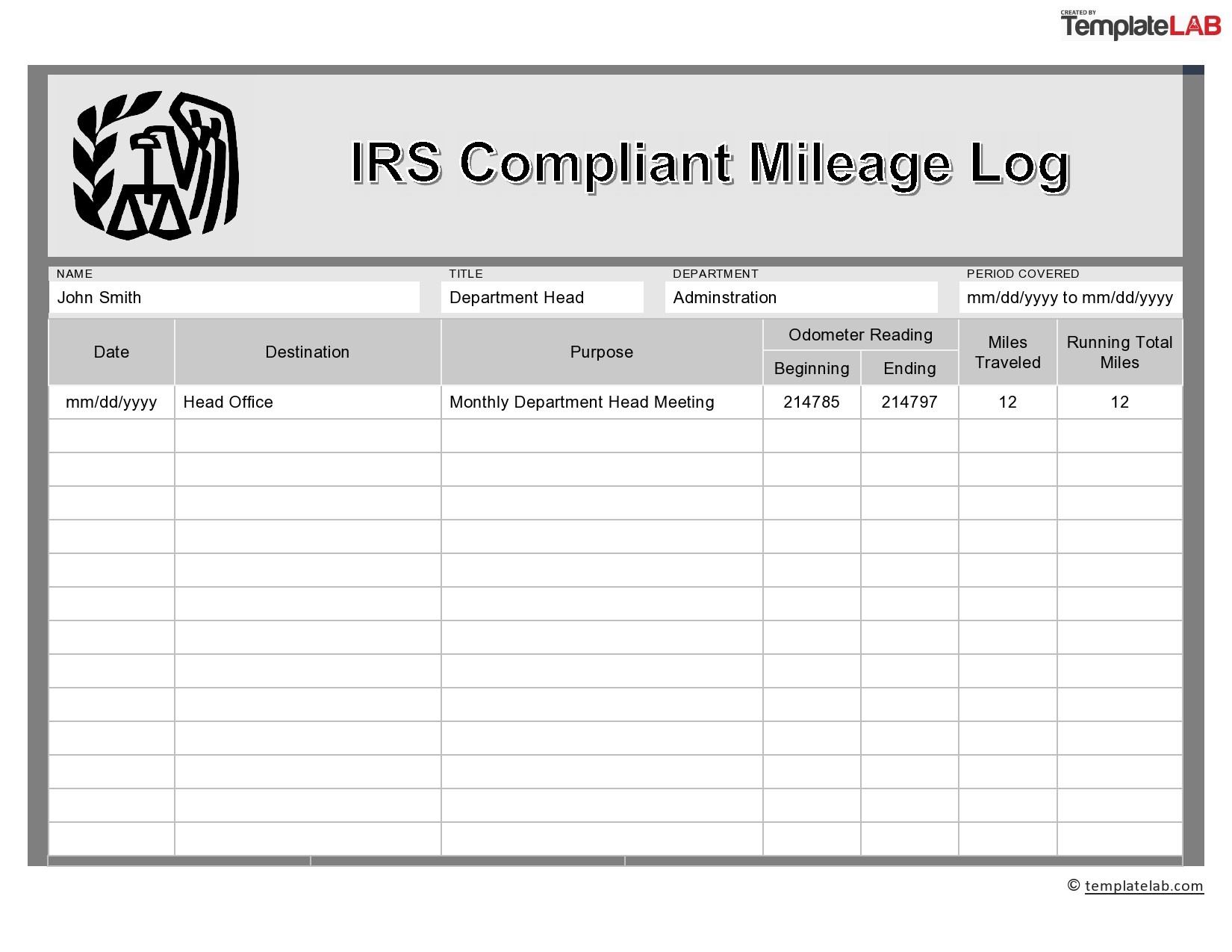

Irs Mileage Log Template

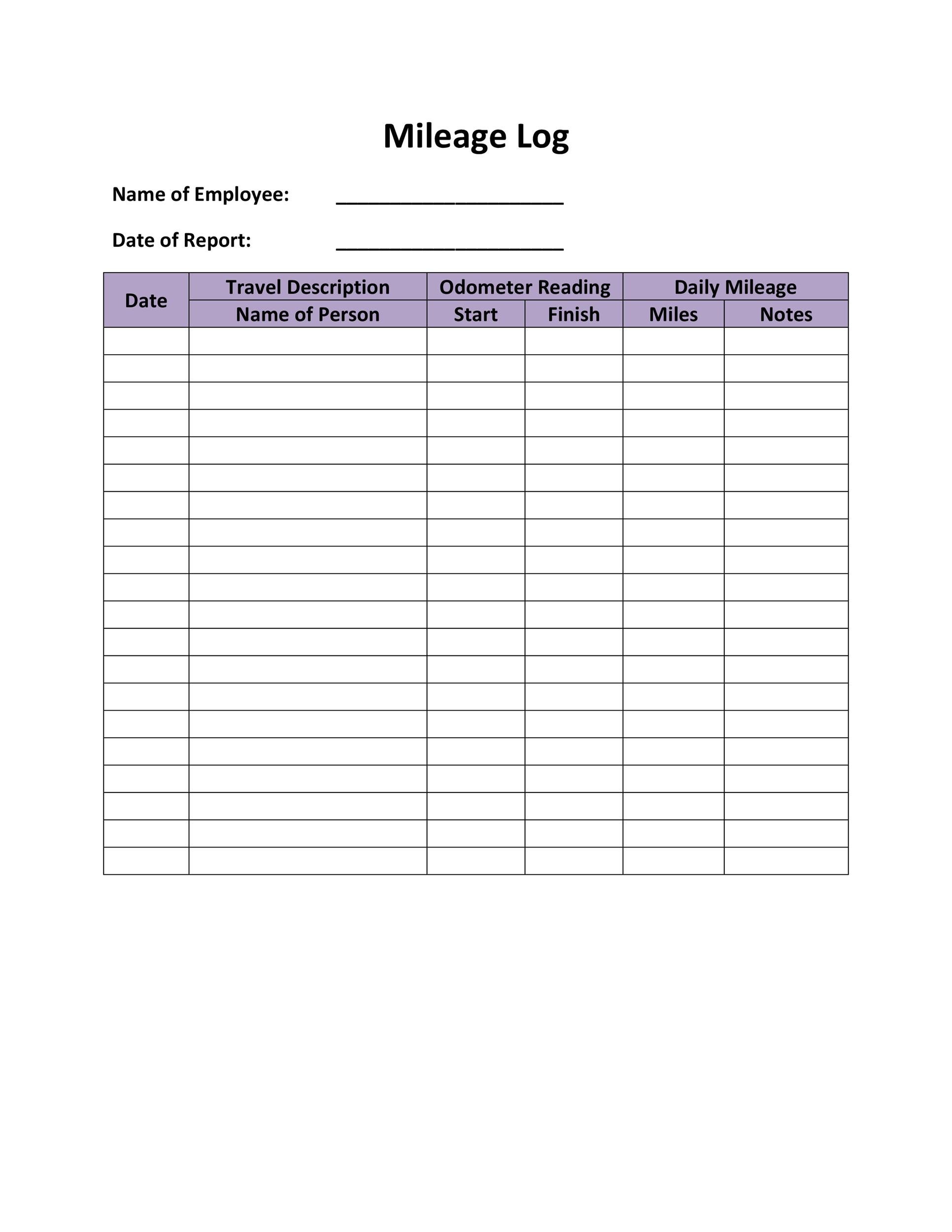

Irs Mileage Log Template - Car expenses and use of the. Web according to the irs, you must include the following in your mileage log template: The irs has been known to. For 2023, the standard mileage rate for the cost of operating your car for business use is 65.5 cents ($0.655) per mile. Web this free mileage log template tracks your trips and automatically calculates your mileage deduction on each one. Web the easiest way to keep records is to use a mileage log template that will have spaces for you to record your mileage for each trip you take.

Car expenses and use of the. Web this free mileage log template tracks your trips and automatically calculates your mileage deduction on each one. For 2023, the standard mileage rate for the cost of operating your car for business use is 65.5 cents ($0.655) per mile. Web according to the irs, you must include the following in your mileage log template: The irs has been known to. Web the easiest way to keep records is to use a mileage log template that will have spaces for you to record your mileage for each trip you take.

Car expenses and use of the. The irs has been known to. Web this free mileage log template tracks your trips and automatically calculates your mileage deduction on each one. Web according to the irs, you must include the following in your mileage log template: For 2023, the standard mileage rate for the cost of operating your car for business use is 65.5 cents ($0.655) per mile. Web the easiest way to keep records is to use a mileage log template that will have spaces for you to record your mileage for each trip you take.

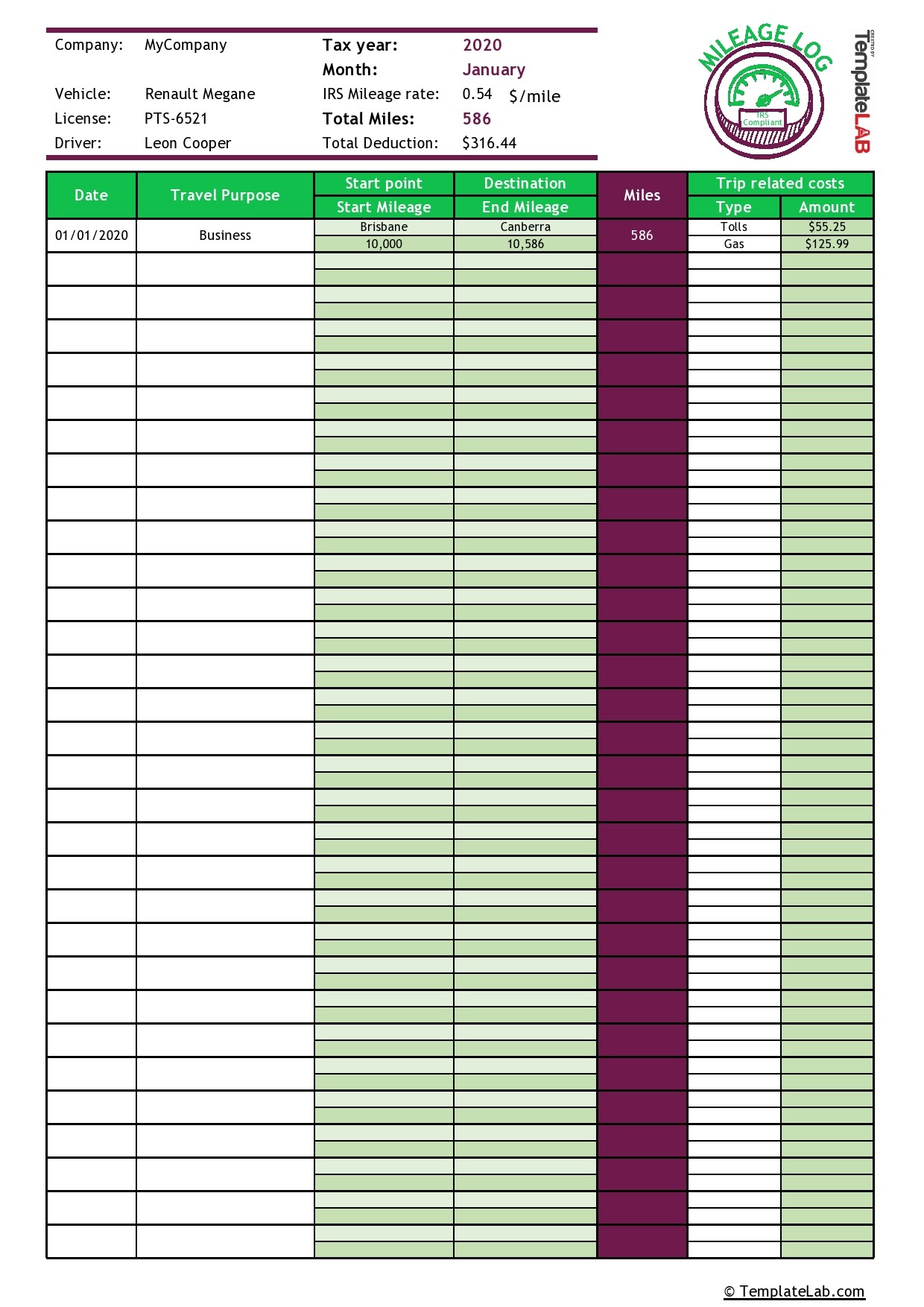

20 Printable Mileage Log Templates (Free) ᐅ TemplateLab

Web according to the irs, you must include the following in your mileage log template: Car expenses and use of the. Web the easiest way to keep records is to use a mileage log template that will have spaces for you to record your mileage for each trip you take. For 2023, the standard mileage rate for the cost of.

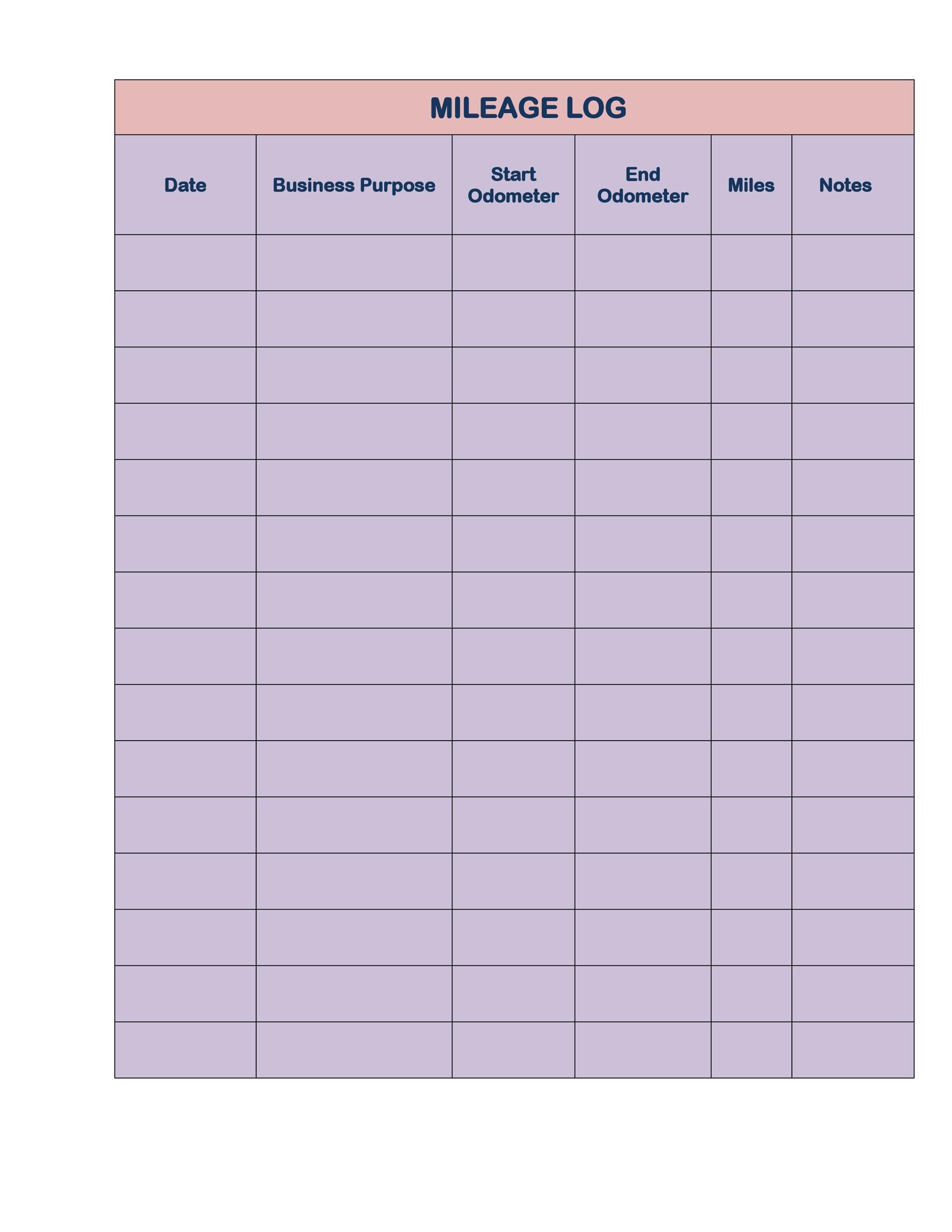

25 Printable IRS Mileage Tracking Templates GOFAR

Web this free mileage log template tracks your trips and automatically calculates your mileage deduction on each one. Web according to the irs, you must include the following in your mileage log template: Web the easiest way to keep records is to use a mileage log template that will have spaces for you to record your mileage for each trip.

30 Printable Mileage Log Templates (Free) Template Lab

Car expenses and use of the. The irs has been known to. Web the easiest way to keep records is to use a mileage log template that will have spaces for you to record your mileage for each trip you take. For 2023, the standard mileage rate for the cost of operating your car for business use is 65.5 cents.

25 Printable IRS Mileage Tracking Templates GOFAR

For 2023, the standard mileage rate for the cost of operating your car for business use is 65.5 cents ($0.655) per mile. Web according to the irs, you must include the following in your mileage log template: Web this free mileage log template tracks your trips and automatically calculates your mileage deduction on each one. The irs has been known.

31 Printable Mileage Log Templates (Free) ᐅ TemplateLab

Web according to the irs, you must include the following in your mileage log template: For 2023, the standard mileage rate for the cost of operating your car for business use is 65.5 cents ($0.655) per mile. The irs has been known to. Car expenses and use of the. Web this free mileage log template tracks your trips and automatically.

20 Printable Mileage Log Templates (Free) ᐅ TemplateLab

Car expenses and use of the. For 2023, the standard mileage rate for the cost of operating your car for business use is 65.5 cents ($0.655) per mile. Web according to the irs, you must include the following in your mileage log template: Web the easiest way to keep records is to use a mileage log template that will have.

25 Printable IRS Mileage Tracking Templates GOFAR

For 2023, the standard mileage rate for the cost of operating your car for business use is 65.5 cents ($0.655) per mile. Web the easiest way to keep records is to use a mileage log template that will have spaces for you to record your mileage for each trip you take. Car expenses and use of the. Web according to.

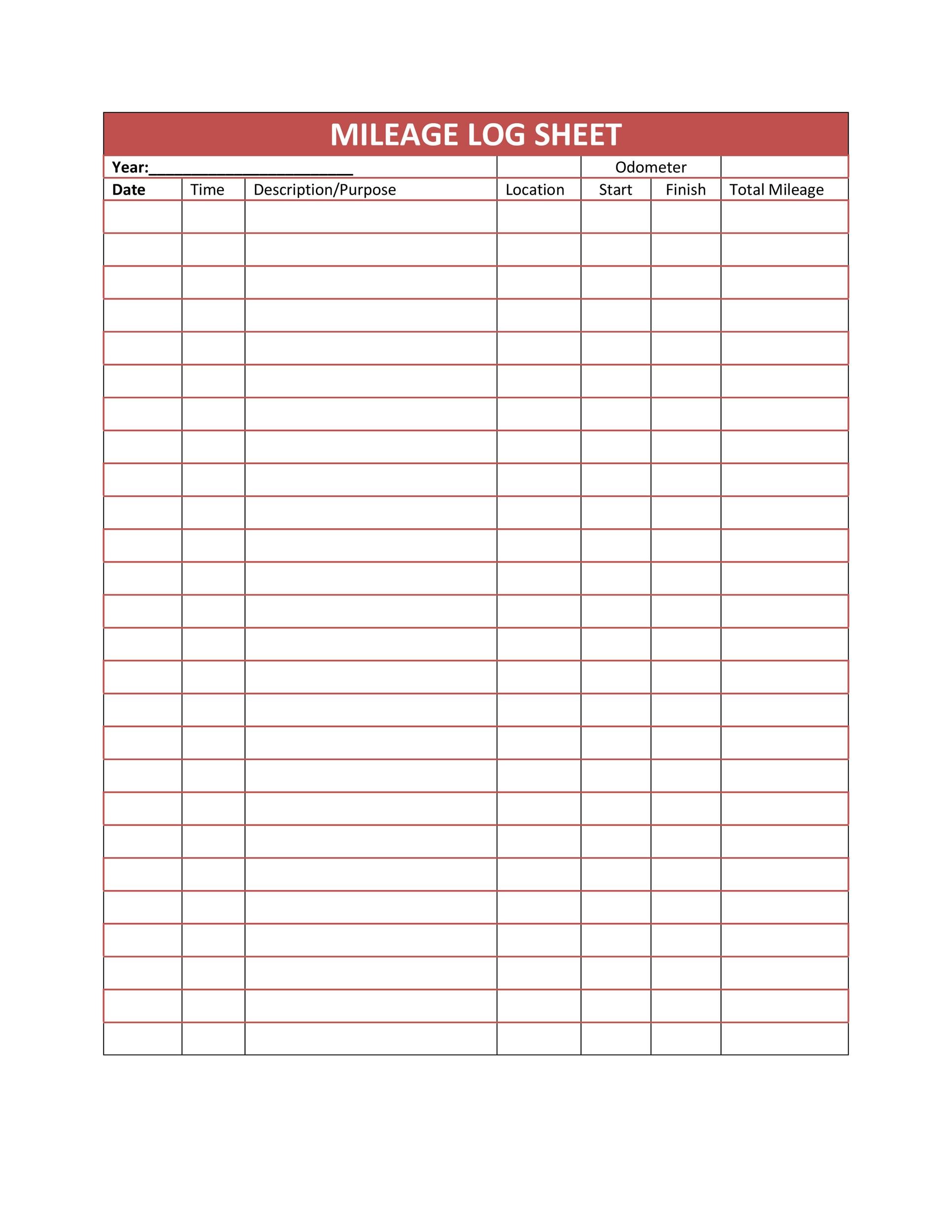

30 Printable Mileage Log Templates (Free) Template Lab

Web this free mileage log template tracks your trips and automatically calculates your mileage deduction on each one. The irs has been known to. Web according to the irs, you must include the following in your mileage log template: Web the easiest way to keep records is to use a mileage log template that will have spaces for you to.

25 Printable IRS Mileage Tracking Templates GOFAR

Car expenses and use of the. Web this free mileage log template tracks your trips and automatically calculates your mileage deduction on each one. The irs has been known to. Web according to the irs, you must include the following in your mileage log template: For 2023, the standard mileage rate for the cost of operating your car for business.

25 Printable IRS Mileage Tracking Templates GOFAR

Web according to the irs, you must include the following in your mileage log template: Web the easiest way to keep records is to use a mileage log template that will have spaces for you to record your mileage for each trip you take. Web this free mileage log template tracks your trips and automatically calculates your mileage deduction on.

Web The Easiest Way To Keep Records Is To Use A Mileage Log Template That Will Have Spaces For You To Record Your Mileage For Each Trip You Take.

For 2023, the standard mileage rate for the cost of operating your car for business use is 65.5 cents ($0.655) per mile. The irs has been known to. Web this free mileage log template tracks your trips and automatically calculates your mileage deduction on each one. Car expenses and use of the.