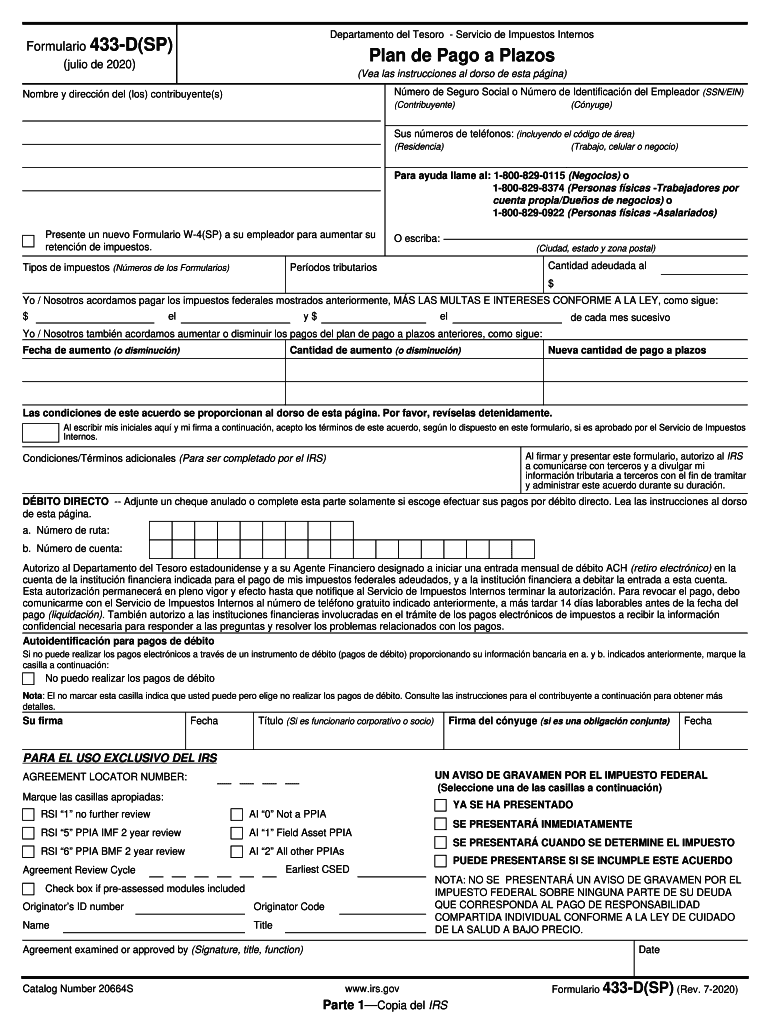

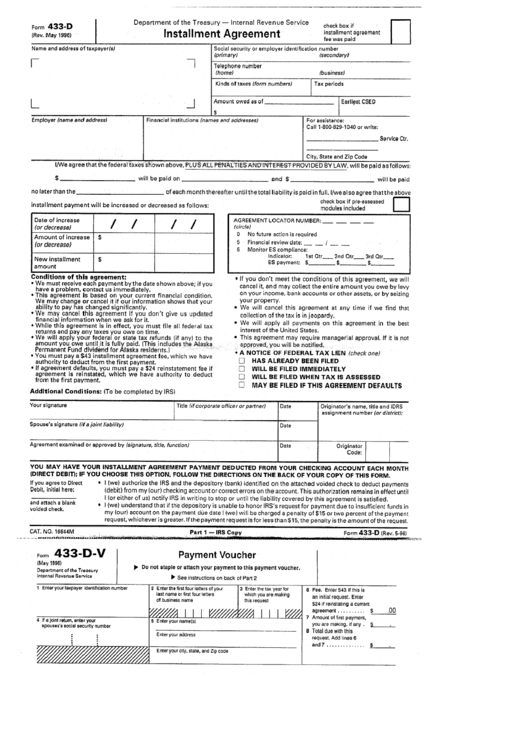

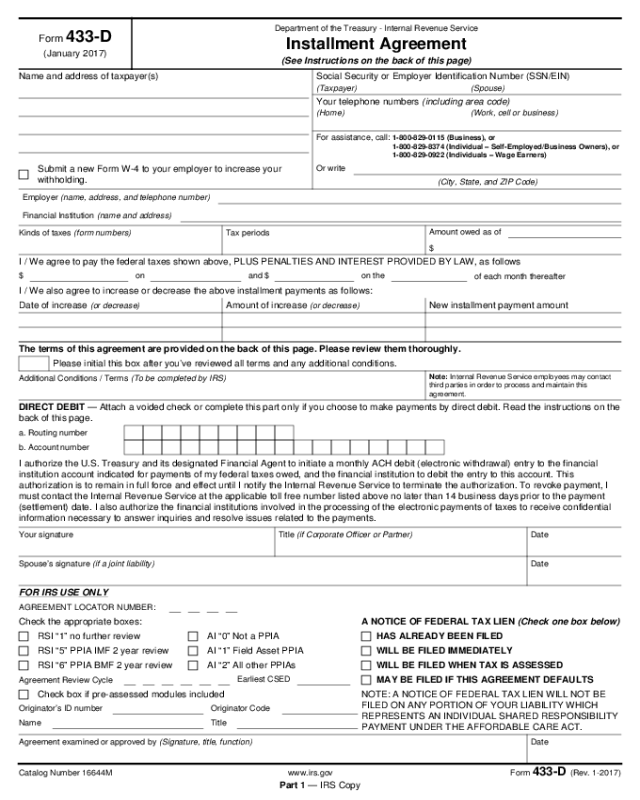

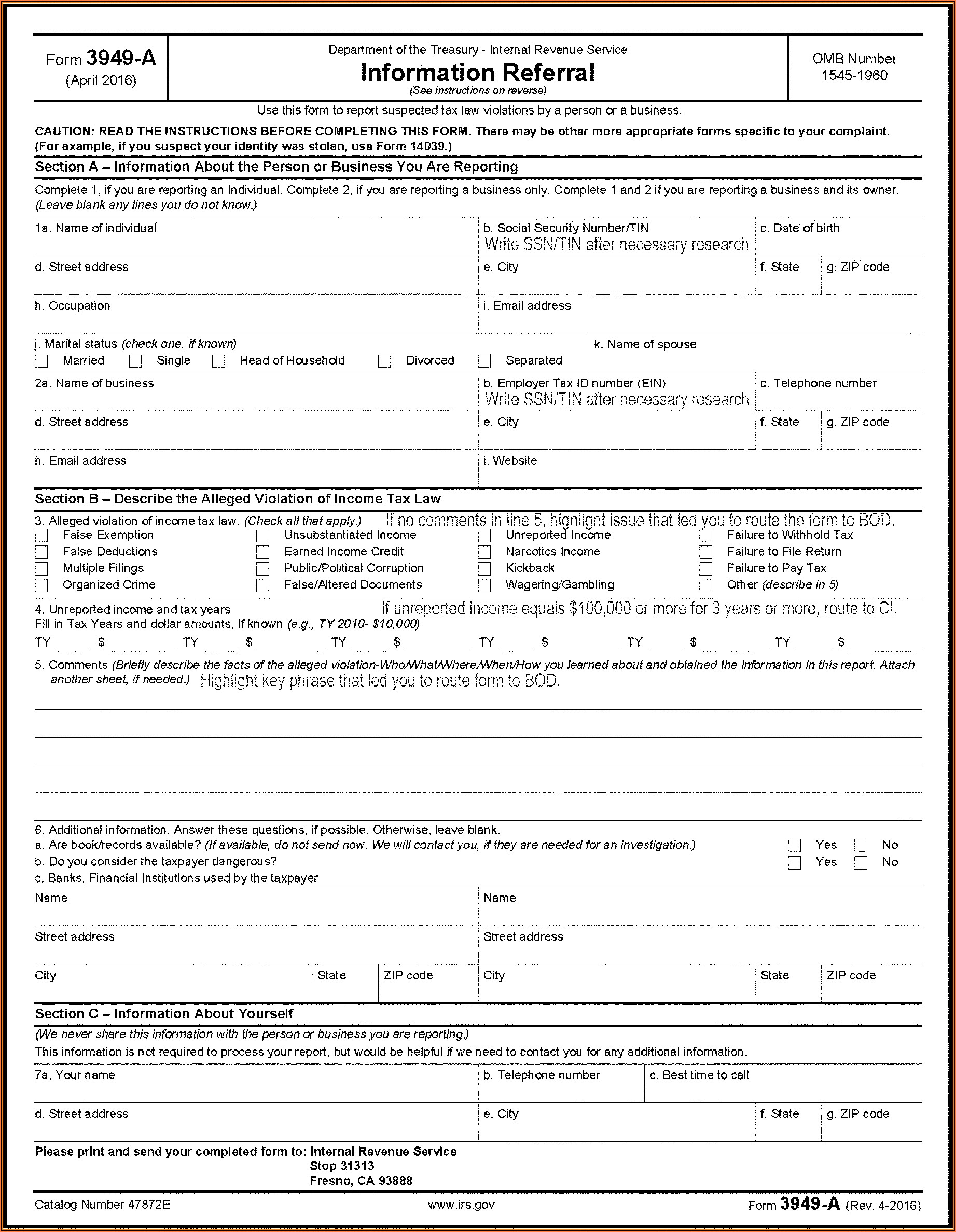

Irs Form 433 D Printable

Irs Form 433 D Printable - Web this is the amount earned after ordinary and necessary monthly business expenses are paid. Enter monthly net rental income. Individual taxpayers and wage earners; Individual income tax return an individual with a personal liability for excise tax Web the document you are trying to load requires adobe reader 8 or higher. Web under 65 65 and over if you or your spouse are self employed or have self employment income, provide the following information: The document finalizes the agreement between an individual or a business and the irs. If the net business income is a loss, enter “0”. Use this form if you are an individual who owes income tax on a form 1040, u.s. However, you need a form 9465 from the irs to initiate the tax resolution.

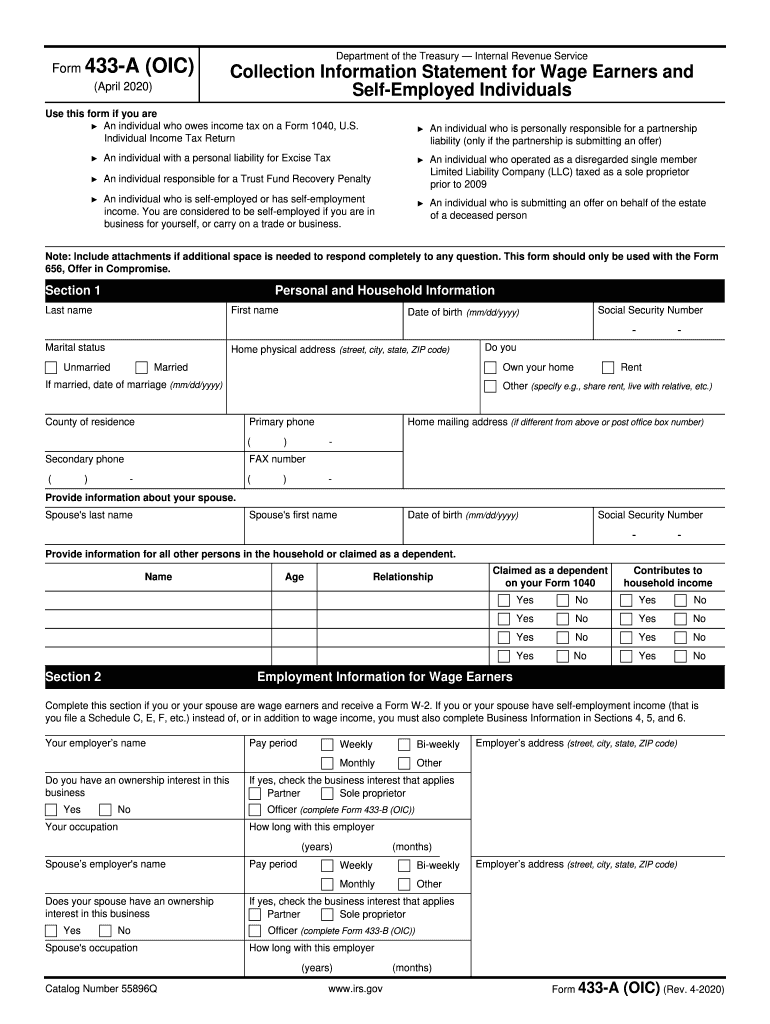

Use this form if you are an individual who owes income tax on a form 1040, u.s. If the net business income is a loss, enter “0”. Business information complete e1 for accounts receivable owed to you or your business. The document finalizes the agreement between an individual or a business and the irs. Individual taxpayers and wage earners; This figure is the amount from page 6, line 89. Individual income tax return an individual with a personal liability for excise tax Do not enter a negative number. You may not have the adobe reader installed or your viewing environment may not be properly. Web the document you are trying to load requires adobe reader 8 or higher.

The document finalizes the agreement between an individual or a business and the irs. Business information complete e1 for accounts receivable owed to you or your business. If the net business income is a loss, enter “0”. Known as an installment agreement, this form takes information related to the amount due and helps the parties come to a reasonable installment plan to pay off what is owed. Do not enter a negative number. Web this is the amount earned after ordinary and necessary monthly business expenses are paid. This figure is the amount from page 6, line 89. Web under 65 65 and over if you or your spouse are self employed or have self employment income, provide the following information: If this amount is more or less than previous years, attach an explanation. Web the document you are trying to load requires adobe reader 8 or higher.

433 D Fax Number Fill Out and Sign Printable PDF Template signNow

Web the document you are trying to load requires adobe reader 8 or higher. You may not have the adobe reader installed or your viewing environment may not be properly. If the net business income is a loss, enter “0”. Web this is the amount earned after ordinary and necessary monthly business expenses are paid. This figure is the amount.

Form 433D Installment Agreement Internal Revenue Service printable

Individual taxpayers and wage earners; You may not have the adobe reader installed or your viewing environment may not be properly. Do not enter a negative number. If the net business income is a loss, enter “0”. If this amount is more or less than previous years, attach an explanation.

Stephen B. Jordan, EA Form 433A / Form 433F

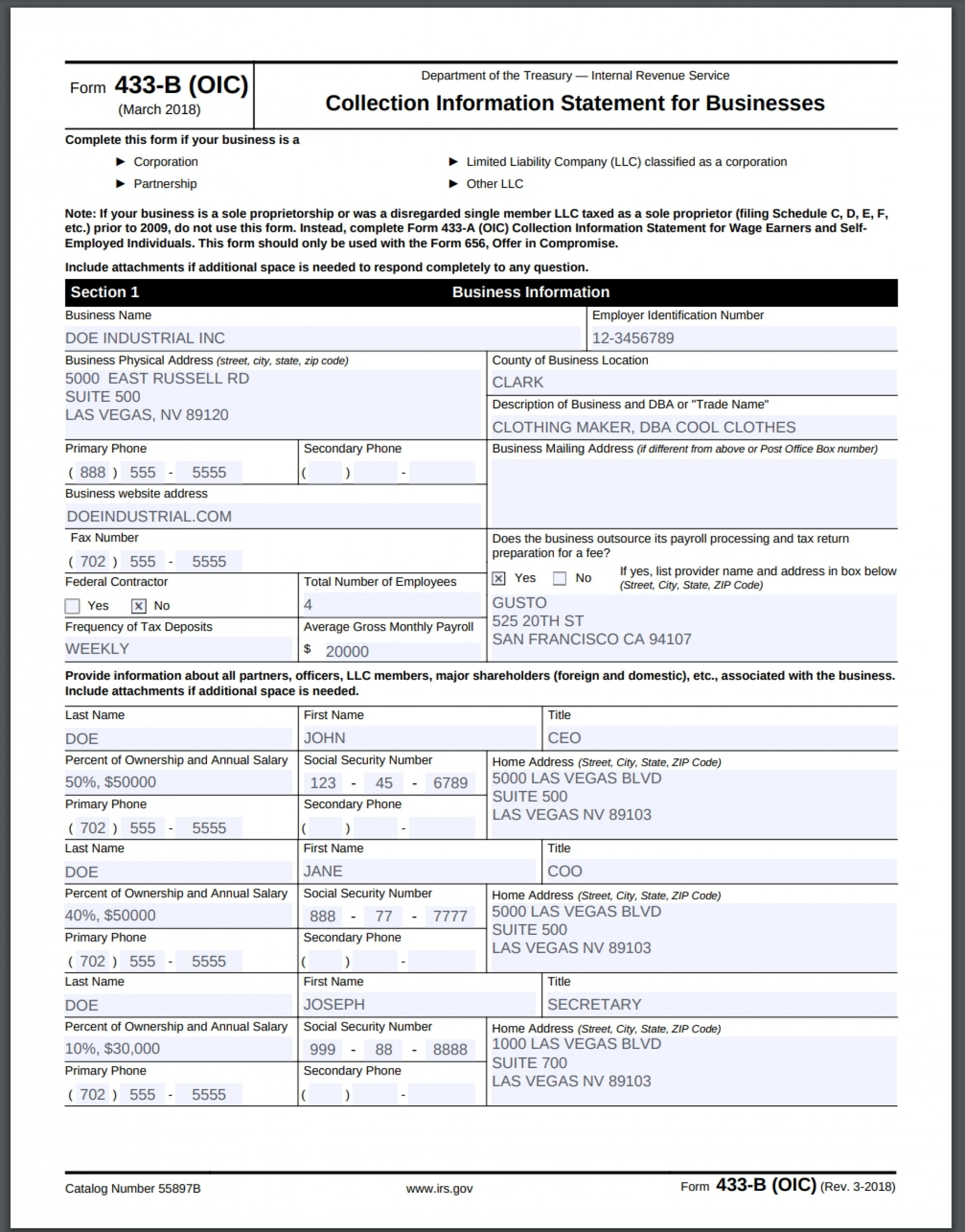

Business information complete e1 for accounts receivable owed to you or your business. The document finalizes the agreement between an individual or a business and the irs. Enter monthly net rental income. You may not have the adobe reader installed or your viewing environment may not be properly. Individual income tax return an individual with a personal liability for excise.

Form 433d Edit, Fill, Sign Online Handypdf

Web the document you are trying to load requires adobe reader 8 or higher. Web this is the amount earned after ordinary and necessary monthly business expenses are paid. Individual taxpayers and wage earners; You may not have the adobe reader installed or your viewing environment may not be properly. Individual income tax return an individual with a personal liability.

Where Do I Mail Irs Form 433 D To Form Resume Examples My3aXQ9aKw

The document finalizes the agreement between an individual or a business and the irs. This figure is the amount from page 6, line 89. You may not have the adobe reader installed or your viewing environment may not be properly. Web under 65 65 and over if you or your spouse are self employed or have self employment income, provide.

Where To Fax Tax Form 433 D Form Resume Examples N8VZlmO9we

Individual income tax return an individual with a personal liability for excise tax However, you need a form 9465 from the irs to initiate the tax resolution. Do not enter a negative number. You may not have the adobe reader installed or your viewing environment may not be properly. Business information complete e1 for accounts receivable owed to you or.

20182020 Form IRS 433D Fill Online, Printable, Fillable, Blank

Use this form if you are an individual who owes income tax on a form 1040, u.s. Individual taxpayers and wage earners; If this amount is more or less than previous years, attach an explanation. Web the document you are trying to load requires adobe reader 8 or higher. Business information complete e1 for accounts receivable owed to you or.

2020 Form IRS 433A (OIC) Fill Online, Printable, Fillable, Blank

Business information complete e1 for accounts receivable owed to you or your business. This figure is the amount from page 6, line 89. Do not enter a negative number. Web under 65 65 and over if you or your spouse are self employed or have self employment income, provide the following information: Individual income tax return an individual with a.

Irs Form 433 D Fillable Form Resume Examples YL5zejyDzV

Use this form if you are an individual who owes income tax on a form 1040, u.s. The document finalizes the agreement between an individual or a business and the irs. If the net business income is a loss, enter “0”. You may not have the adobe reader installed or your viewing environment may not be properly. Do not enter.

Form 433 A Tax Alloble Expenses 433D Instructions —

Known as an installment agreement, this form takes information related to the amount due and helps the parties come to a reasonable installment plan to pay off what is owed. The document finalizes the agreement between an individual or a business and the irs. If the net business income is a loss, enter “0”. Business information complete e1 for accounts.

Individual Taxpayers And Wage Earners;

You may not have the adobe reader installed or your viewing environment may not be properly. Web under 65 65 and over if you or your spouse are self employed or have self employment income, provide the following information: This figure is the amount from page 6, line 89. Web the document you are trying to load requires adobe reader 8 or higher.

The Document Finalizes The Agreement Between An Individual Or A Business And The Irs.

Individual income tax return an individual with a personal liability for excise tax Enter monthly net rental income. However, you need a form 9465 from the irs to initiate the tax resolution. Business information complete e1 for accounts receivable owed to you or your business.

Known As An Installment Agreement, This Form Takes Information Related To The Amount Due And Helps The Parties Come To A Reasonable Installment Plan To Pay Off What Is Owed.

Web this is the amount earned after ordinary and necessary monthly business expenses are paid. If this amount is more or less than previous years, attach an explanation. If the net business income is a loss, enter “0”. Do not enter a negative number.