Free Printable Tax Deduction Worksheet

Free Printable Tax Deduction Worksheet - You filed form 4361, but you had $400 or more. If you are a minister, member of a religious order, or christian science practitioner. Publication 502 (2021), medical and dental expenses. Web farm worksheet december 31, 2022 farm income 2022 page 1 description of property quantity sale price cattle hogs. Web compile information for your individual tax return with ease using our 2022 tax organizer and spreadsheets. Track your rental finances by entering the relevant amounts into each itemized category, such as rent and fees in the “rental income” category or hoa dues, gardening service and utilities in the “monthly expense” category. Web do you have any dependents that you are claiming? Getting to write off your housing costs. Simply follow the instructions on this sheet and start lowering your social security and medicare taxes. If yes, fill out worksheet on page 3.

Track your rental finances by entering the relevant amounts into each itemized category, such as rent and fees in the “rental income” category or hoa dues, gardening service and utilities in the “monthly expense” category. Web printable tax documentation checklist. Use this worksheet to figure the amount, if any, of your. Web compile information for your individual tax return with ease using our 2022 tax organizer and spreadsheets. Web printable tax deduction worksheet. Your receipts should include a reasonably accurate likewise, if one made donations to four separate entities, a. If yes, fill out worksheet on page 3. Web use the following tax deduction checklist when filing your annual return: Publication 502 (2021), medical and dental expenses. Web farm worksheet december 31, 2022 farm income 2022 page 1 description of property quantity sale price cattle hogs.

Web printable tax deduction worksheet. The source information that is required for each tax. Did you or any of your dependents have education expenses? If yes, fill out worksheet on page 3. Web use the following tax deduction checklist when filing your annual return: General taxable income ___ alimony received or paid ___ dividend income statements: Web retain this worksheet with your receipts in your tax file. Web printable tax documentation checklist. If yes, fill out worksheet on page 3. Publication 502 (2021), medical and dental expenses.

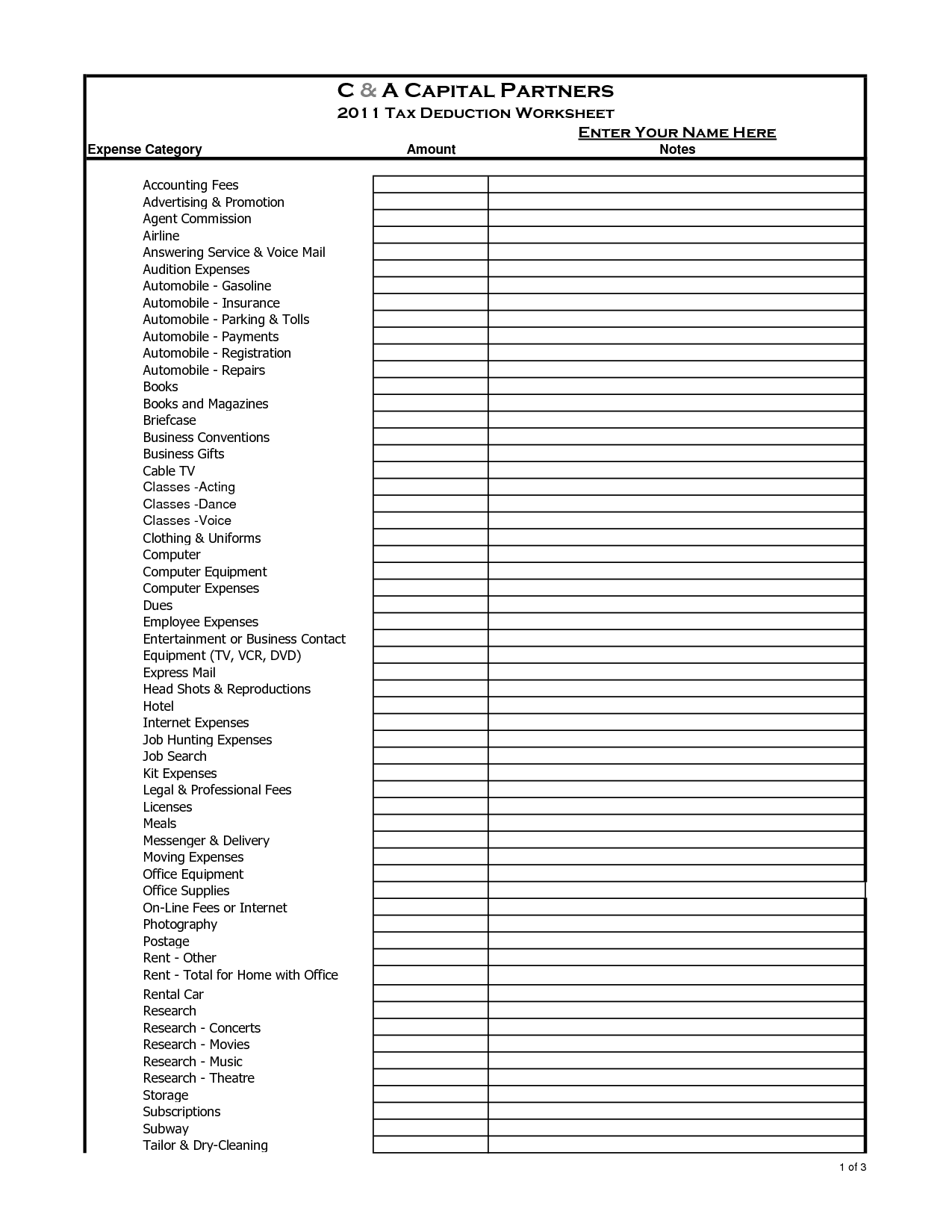

Printable Tax Deduction Worksheet —

Track your rental finances by entering the relevant amounts into each itemized category, such as rent and fees in the “rental income” category or hoa dues, gardening service and utilities in the “monthly expense” category. Web do you have any dependents that you are claiming? If yes, fill out worksheet on pg 3. Web sheet1 sales,professional advertising,seminars appraisal fees,continuing ed.

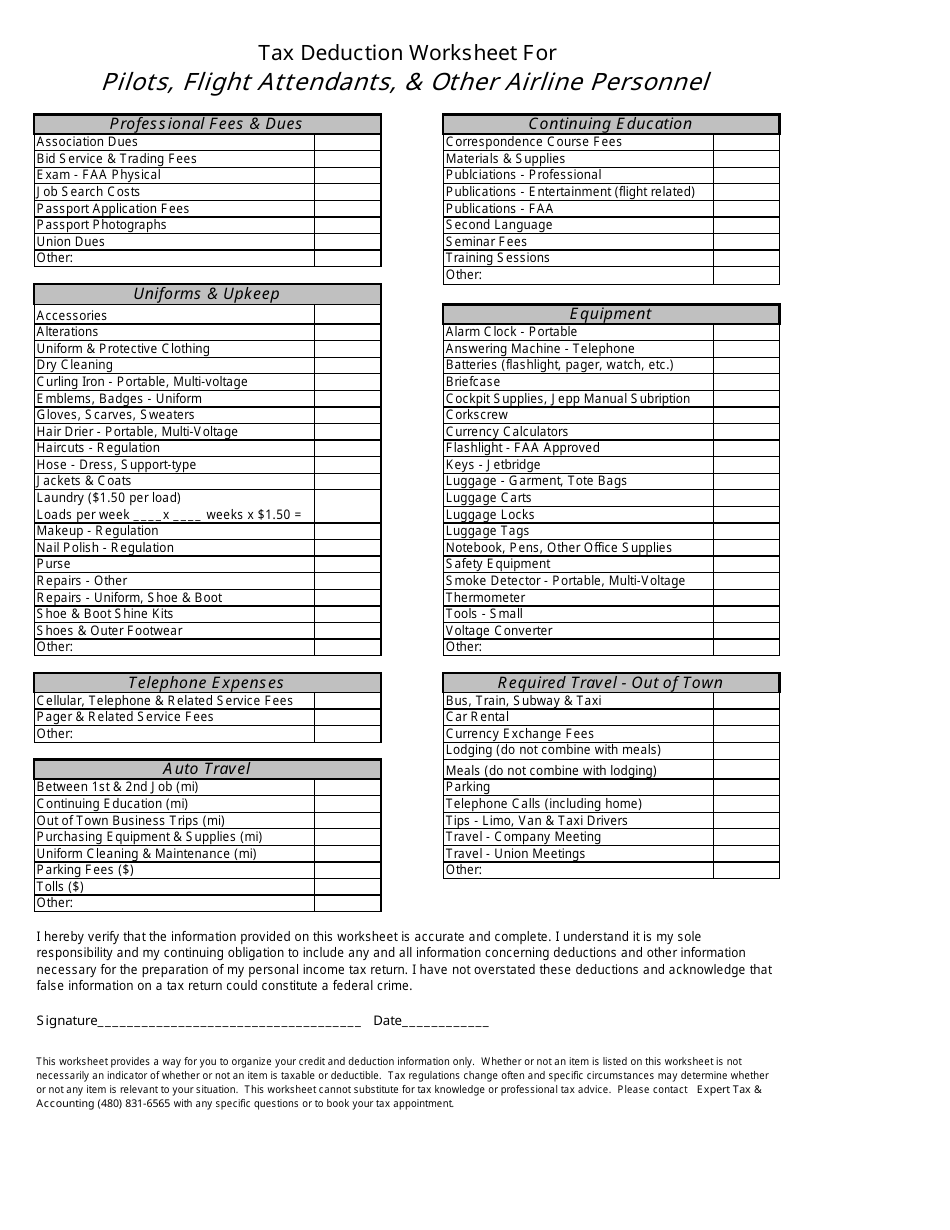

Tax Deduction Worksheet for Pilots, Flight Attendants, & Other Airline

If yes, fill out worksheet on page 3. Web retain this worksheet with your receipts in your tax file. Getting to write off your housing costs. Did you or any of your dependents have education expenses? Church employee income, see instructions for how to report your income and the definition of church employee income.

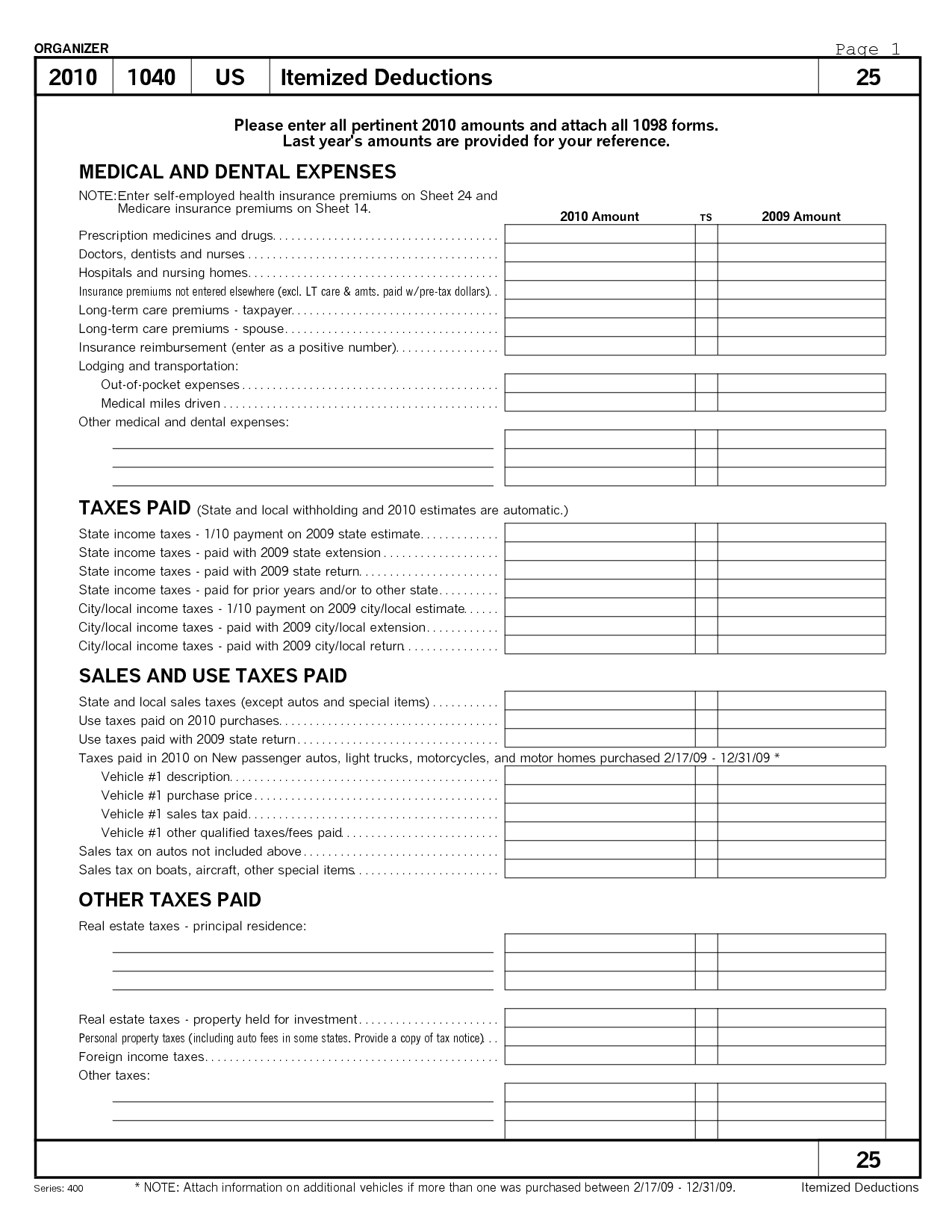

8 Best Images of Monthly Bill Worksheet 2015 Itemized Tax Deduction

Simply follow the instructions on this sheet and start lowering your social security and medicare taxes. If yes, fill out worksheet on pg 3. Use this worksheet to figure the amount, if any, of your. Did you or any of your dependents have education expenses? Getting to write off your housing costs.

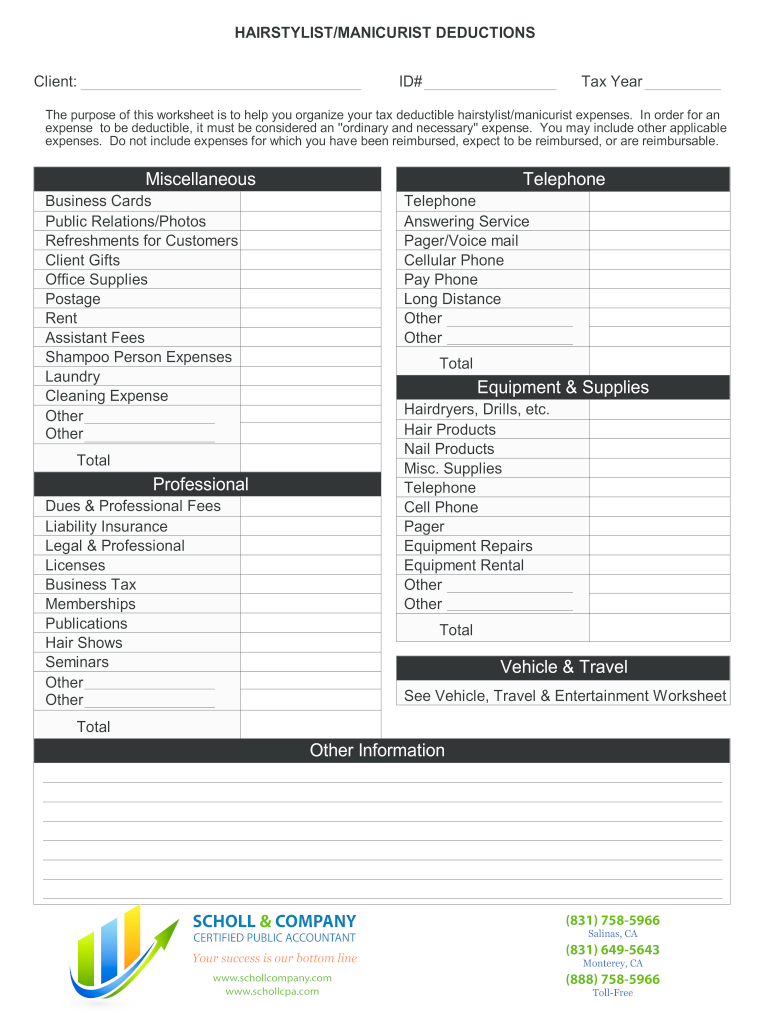

Self Employed Tax Deductions Worksheet Form Fill Out and Sign

Did you or any of your dependents have education expenses? Simply follow the instructions on this sheet and start lowering your social security and medicare taxes. General taxable income ___ alimony received or paid ___ dividend income statements: Track your rental finances by entering the relevant amounts into each itemized category, such as rent and fees in the “rental income”.

Small Business Tax Deductions Worksheet

Web compile information for your individual tax return with ease using our 2022 tax organizer and spreadsheets. You filed form 4361, but you had $400 or more. If yes, fill out worksheet on pg 3. General taxable income ___ alimony received or paid ___ dividend income statements: If yes, fill out worksheet on page 3.

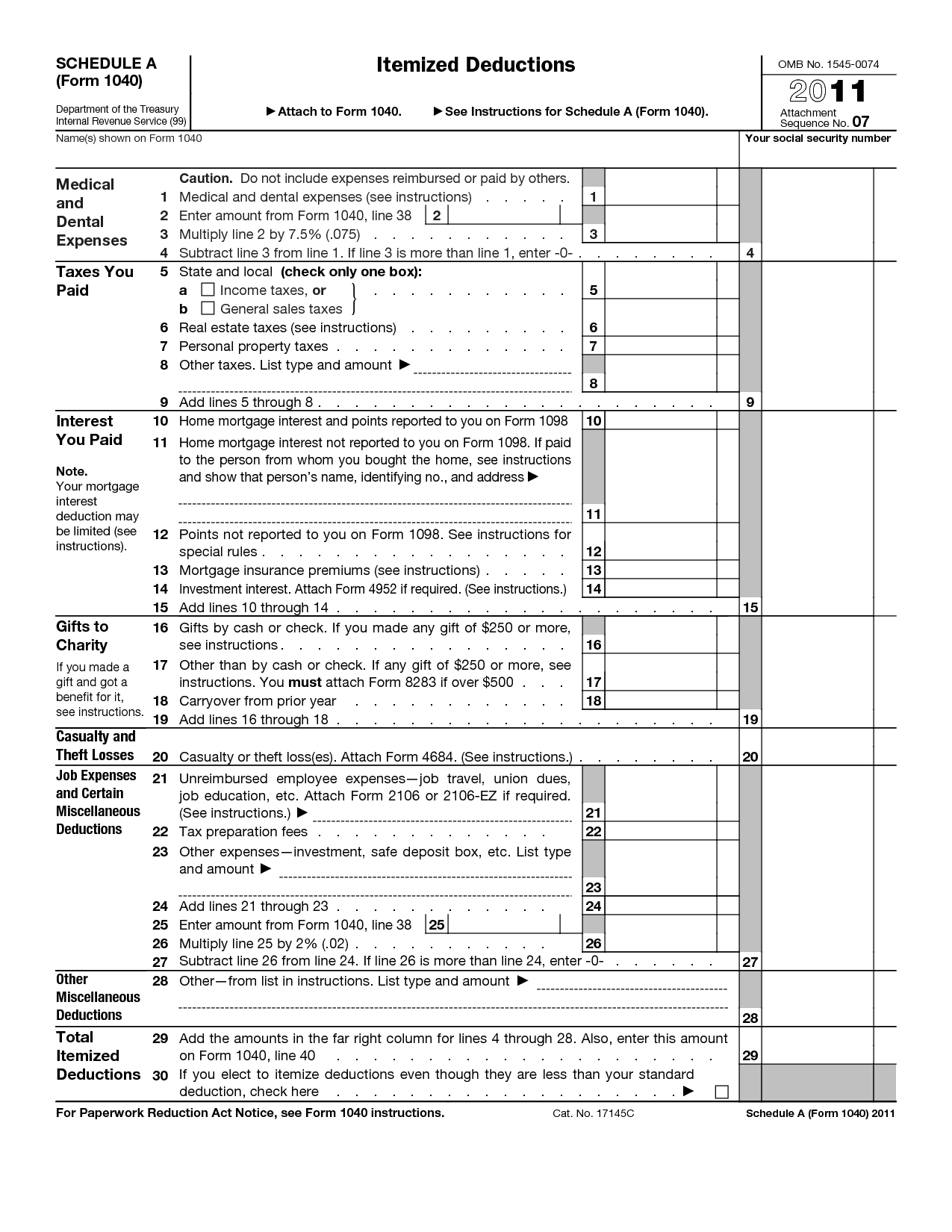

IRS Form 1040 Standard Deduction Worksheet 1040 Form Printable

You filed form 4361, but you had $400 or more. Track your rental finances by entering the relevant amounts into each itemized category, such as rent and fees in the “rental income” category or hoa dues, gardening service and utilities in the “monthly expense” category. Web use the following tax deduction checklist when filing your annual return: If you are.

8 Best Images of Tax Preparation Organizer Worksheet Individual

You filed form 4361, but you had $400 or more. Church employee income, see instructions for how to report your income and the definition of church employee income. General taxable income ___ alimony received or paid ___ dividend income statements: Your receipts should include a reasonably accurate likewise, if one made donations to four separate entities, a. Publication 502 (2021),.

Tax Deduction Worksheet for Police Officers Fill and Sign Printable

Use this worksheet to figure the amount, if any, of your. Web these free printable tax deduction worksheets can be customized to fit the needs of the individual trainee or classroom, and can be utilized as a supplement to conventional class direction or for extracurricular activities and also rate of interests. Web printable tax deduction worksheet. Web compile information for.

Tax De Trucker Tax Deduction Worksheet Great Linear —

You may reduce the amount of tax withheld from your wages by claiming one additional withholding allowance for each $1,000, or fraction of $1,000, by which you. If yes, fill out worksheet on pg 3. Getting to write off your housing costs. Simply follow the instructions on this sheet and start lowering your social security and medicare taxes. The source.

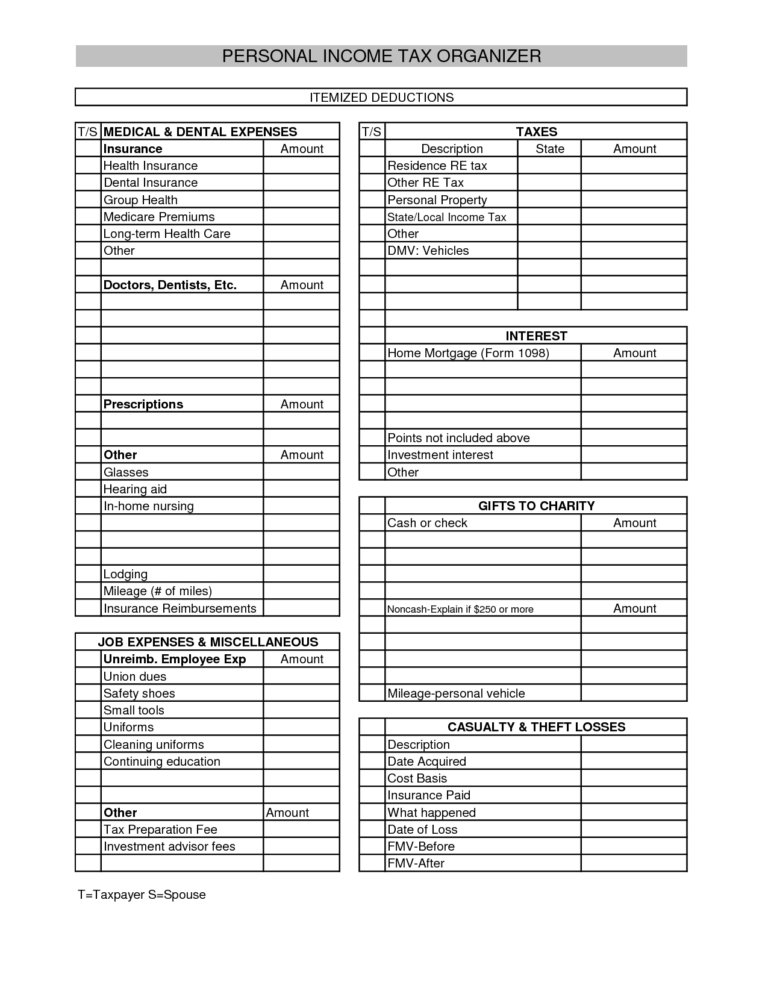

Itemized Tax Deduction Worksheet

Church employee income, see instructions for how to report your income and the definition of church employee income. Publication 502 (2021), medical and dental expenses. Click to print personal tax preparation checklist for individuals. Web a goodwill donation receipt is used to claim a tax deduction for clothing and household property that are itemized on an individual’s taxes. Web do.

Jan 13, 2022 — Instructions:

Church employee income, see instructions for how to report your income and the definition of church employee income. Web printable tax deduction worksheet. If yes, fill out worksheet on pg 3. If yes, fill out worksheet on page 3.

Did Your Children Attend Private Elementary Or High School In Wi?

Web download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. A donor is responsible for. Did you or any of your dependents have education expenses? Did you pay anyone for childcare expenses?

You May Reduce The Amount Of Tax Withheld From Your Wages By Claiming One Additional Withholding Allowance For Each $1,000, Or Fraction Of $1,000, By Which You.

Getting to write off your housing costs. Publication 502 (2021), medical and dental expenses. Your receipts should include a reasonably accurate likewise, if one made donations to four separate entities, a. Web retain this worksheet with your receipts in your tax file.

Web Do You Have Any Dependents That You Are Claiming?

General taxable income ___ alimony received or paid ___ dividend income statements: You filed form 4361, but you had $400 or more. Web compile information for your individual tax return with ease using our 2022 tax organizer and spreadsheets. Click to print personal tax preparation checklist for individuals.