Form 8962 Printable

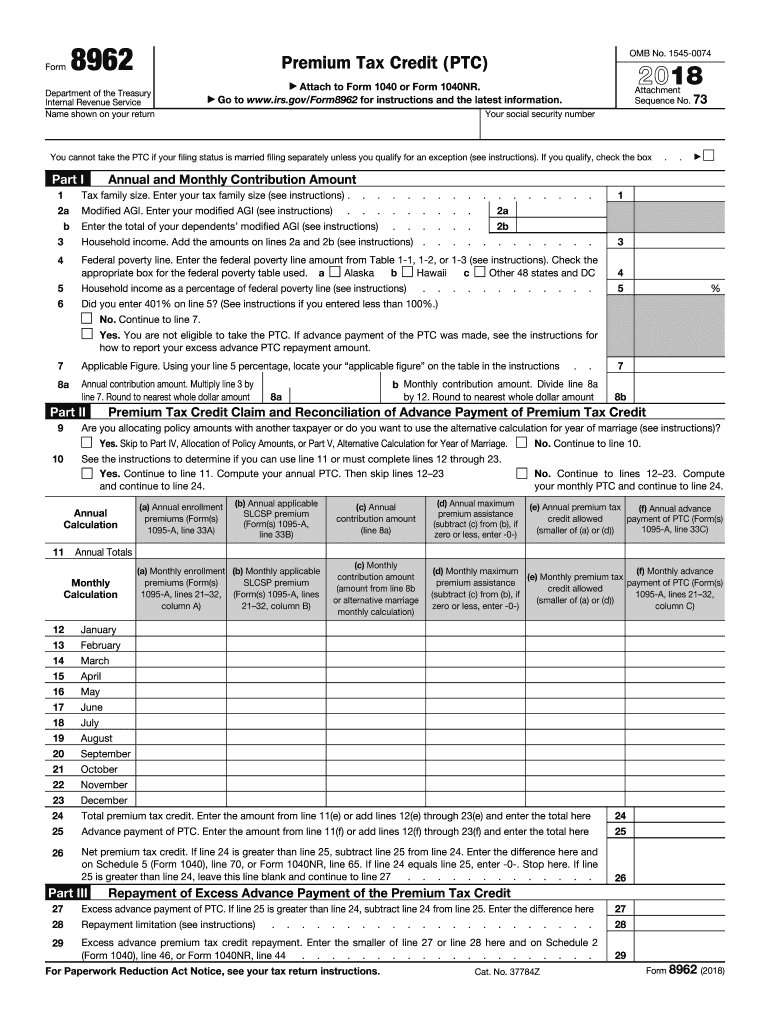

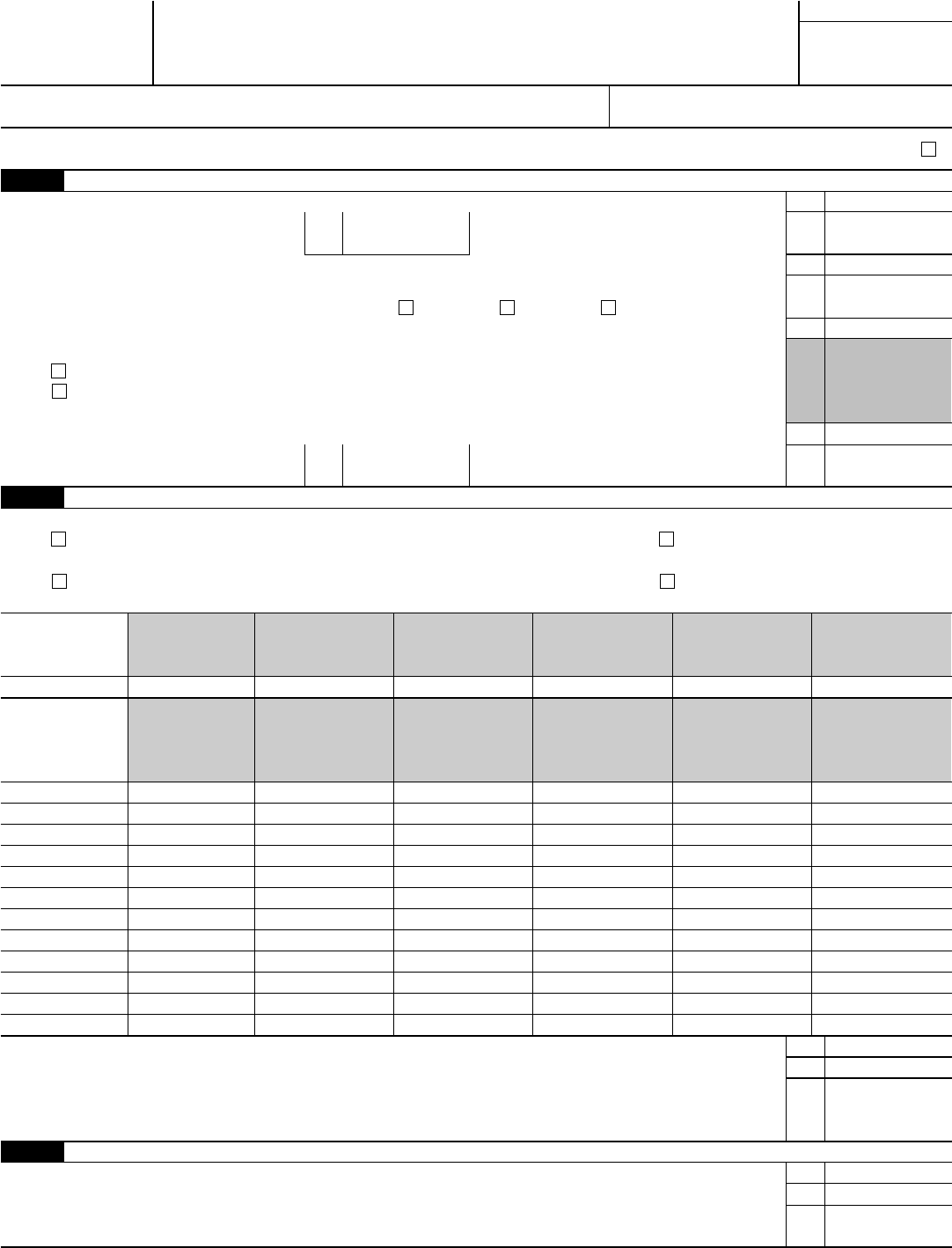

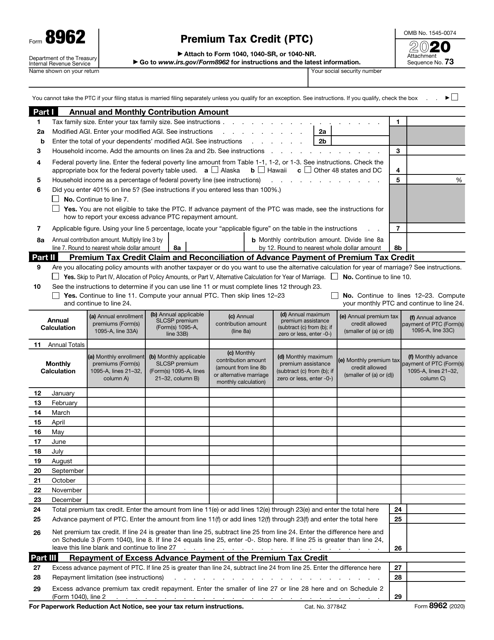

Form 8962 Printable - Web if you filed your taxes without form 8962, but need to include it, don’t amend your return. Web your electronic return was rejected because irs records show that advance payments of the premium tax credit (aptc) were paid to your marketplace health insurance company on behalf of a member of your family in 2021, and you are required to complete form 8962 and attach it to your return to reconcile the aptc with the premium tax credit. Web get 📝 form 8962 with all detailed instructions on how to file online 📝 irs 8962 form for 2020 🟢 printable template in pdf 🟢 detailed guide for tax form filling Wait until the irs sends you a notice requesting the form. Web for 2022, you’ll have to report the excess aptc on your 2022 tax return or file form 8962, premium tax credit (pdf, 110 kb). Web you’ll need it to complete form 8962, premium tax credit. You can print other federal tax forms here. Web we last updated the premium tax credit in december 2022, so this is the latest version of form 8962, fully updated for tax year 2022. 73 name shown on your return your social security number a. Enrollment premiums second lowest cost silver plan (slcsp) premium advance payment of premium tax credit complete all sections of form 8962.

Wait until the irs sends you a notice requesting the form. Web form 8962 is used to estimate the amount of premium tax credit for which you’re eligible if you’re insured through the health insurance marketplace. Web we last updated the premium tax credit in december 2022, so this is the latest version of form 8962, fully updated for tax year 2022. Web when you're done in turbotax, you'll need to print out form 8962 and mail or fax it to the irs, along with any other items requested in your 12c letter. You need to complete form 8962 if you wish. Web for 2022, you’ll have to report the excess aptc on your 2022 tax return or file form 8962, premium tax credit (pdf, 110 kb). Form 8962 is used either (1) to reconcile a premium tax credit advanced payment toward the cost of a health insurance. Enrollment premiums second lowest cost silver plan (slcsp) premium advance payment of premium tax credit complete all sections of form 8962. Even if you estimated your income perfectly, you must complete form 8962 and submit it with your federal tax return. Select the information you need to get details:

Web if you filed your taxes without form 8962, but need to include it, don’t amend your return. Web your electronic return was rejected because irs records show that advance payments of the premium tax credit (aptc) were paid to your marketplace health insurance company on behalf of a member of your family in 2021, and you are required to complete form 8962 and attach it to your return to reconcile the aptc with the premium tax credit. Web you’ll need it to complete form 8962, premium tax credit. Qualified small employer health reimbursement arrangement (qsehra). You can print other federal tax forms here. Form 8962 is used either (1) to reconcile a premium tax credit advanced payment toward the cost of a health insurance. You need to complete form 8962 if you wish. Enrollment premiums second lowest cost silver plan (slcsp) premium advance payment of premium tax credit complete all sections of form 8962. Web form 8962 is used to estimate the amount of premium tax credit for which you’re eligible if you’re insured through the health insurance marketplace. Web when you're done in turbotax, you'll need to print out form 8962 and mail or fax it to the irs, along with any other items requested in your 12c letter.

2016 Form IRS Instructions 8962 Fill Online, Printable, Fillable, Blank

Web get 📝 form 8962 with all detailed instructions on how to file online 📝 irs 8962 form for 2020 🟢 printable template in pdf 🟢 detailed guide for tax form filling Web when you're done in turbotax, you'll need to print out form 8962 and mail or fax it to the irs, along with any other items requested in.

8962 Form App for iPhone Free Download 8962 Form for iPhone & iPad at

Even if you estimated your income perfectly, you must complete form 8962 and submit it with your federal tax return. You can print other federal tax forms here. Web your electronic return was rejected because irs records show that advance payments of the premium tax credit (aptc) were paid to your marketplace health insurance company on behalf of a member.

2019 Form IRS Instructions 8962 Fill Online, Printable, Fillable, Blank

Web get 📝 form 8962 with all detailed instructions on how to file online 📝 irs 8962 form for 2020 🟢 printable template in pdf 🟢 detailed guide for tax form filling Qualified small employer health reimbursement arrangement (qsehra). Web you’ll need it to complete form 8962, premium tax credit. Go to www.irs.gov/form8962 for instructions and the latest information. Select.

Form 8962 Edit, Fill, Sign Online Handypdf

Go to www.irs.gov/form8962 for instructions and the latest information. Reminders applicable federal poverty line percentages. Web you must use form 8962 to reconcile your estimated and actual income for the year. Web your electronic return was rejected because irs records show that advance payments of the premium tax credit (aptc) were paid to your marketplace health insurance company on behalf.

Instructions 8962 2018 2019 Blank Sample to Fill out Online in PDF

Form 8962 is used either (1) to reconcile a premium tax credit advanced payment toward the cost of a health insurance. You can print other federal tax forms here. Web get 📝 form 8962 with all detailed instructions on how to file online 📝 irs 8962 form for 2020 🟢 printable template in pdf 🟢 detailed guide for tax form.

Form 8962 Fill Out and Sign Printable PDF Template signNow

Even if you estimated your income perfectly, you must complete form 8962 and submit it with your federal tax return. Web information about form 8962, premium tax credit, including recent updates, related forms and instructions on how to file. Web print form 8962 (pdf, 110 kb) and instructions (pdf, 348 kb). Web for 2022, you’ll have to report the excess.

Form 8962 Edit, Fill, Sign Online Handypdf

You need to complete form 8962 if you wish. If you’re claiming a net premium tax credit for 2022, including if you got an increase in premium tax credits when you reconciled and filed, you still need to include form 8962. Web we last updated the premium tax credit in december 2022, so this is the latest version of form.

IRS Form 8962 Download Fillable PDF or Fill Online Premium Tax Credit

Web information about form 8962, premium tax credit, including recent updates, related forms and instructions on how to file. Web print form 8962 (pdf, 110 kb) and instructions (pdf, 348 kb). Qualified small employer health reimbursement arrangement (qsehra). Go to www.irs.gov/form8962 for instructions and the latest information. Web you must use form 8962 to reconcile your estimated and actual income.

How to Fill out IRS Form 8962 Correctly?

Web you must use form 8962 to reconcile your estimated and actual income for the year. Web for 2022, you’ll have to report the excess aptc on your 2022 tax return or file form 8962, premium tax credit (pdf, 110 kb). Web form 8962 is used to estimate the amount of premium tax credit for which you’re eligible if you’re.

Www.irs.gov Forms 8962 Universal Network

Reminders applicable federal poverty line percentages. Wait until the irs sends you a notice requesting the form. Web you’ll need it to complete form 8962, premium tax credit. Go to www.irs.gov/form8962 for instructions and the latest information. Web for 2022, you’ll have to report the excess aptc on your 2022 tax return or file form 8962, premium tax credit (pdf,.

Web Your Electronic Return Was Rejected Because Irs Records Show That Advance Payments Of The Premium Tax Credit (Aptc) Were Paid To Your Marketplace Health Insurance Company On Behalf Of A Member Of Your Family In 2021, And You Are Required To Complete Form 8962 And Attach It To Your Return To Reconcile The Aptc With The Premium Tax Credit.

You need to complete form 8962 if you wish. Web we last updated the premium tax credit in december 2022, so this is the latest version of form 8962, fully updated for tax year 2022. You can print other federal tax forms here. Web form 8962 is used to estimate the amount of premium tax credit for which you’re eligible if you’re insured through the health insurance marketplace.

If You’re Claiming A Net Premium Tax Credit For 2022, Including If You Got An Increase In Premium Tax Credits When You Reconciled And Filed, You Still Need To Include Form 8962.

Web when you're done in turbotax, you'll need to print out form 8962 and mail or fax it to the irs, along with any other items requested in your 12c letter. Web you must use form 8962 to reconcile your estimated and actual income for the year. Reminders applicable federal poverty line percentages. 73 name shown on your return your social security number a.

Web Print Form 8962 (Pdf, 110 Kb) And Instructions (Pdf, 348 Kb).

Form 8962 is used either (1) to reconcile a premium tax credit advanced payment toward the cost of a health insurance. Web information about form 8962, premium tax credit, including recent updates, related forms and instructions on how to file. Web get 📝 form 8962 with all detailed instructions on how to file online 📝 irs 8962 form for 2020 🟢 printable template in pdf 🟢 detailed guide for tax form filling Web you’ll need it to complete form 8962, premium tax credit.

Even If You Estimated Your Income Perfectly, You Must Complete Form 8962 And Submit It With Your Federal Tax Return.

Web if you filed your taxes without form 8962, but need to include it, don’t amend your return. Enrollment premiums second lowest cost silver plan (slcsp) premium advance payment of premium tax credit complete all sections of form 8962. Select the information you need to get details: Qualified small employer health reimbursement arrangement (qsehra).