1099 Nec Form Printable

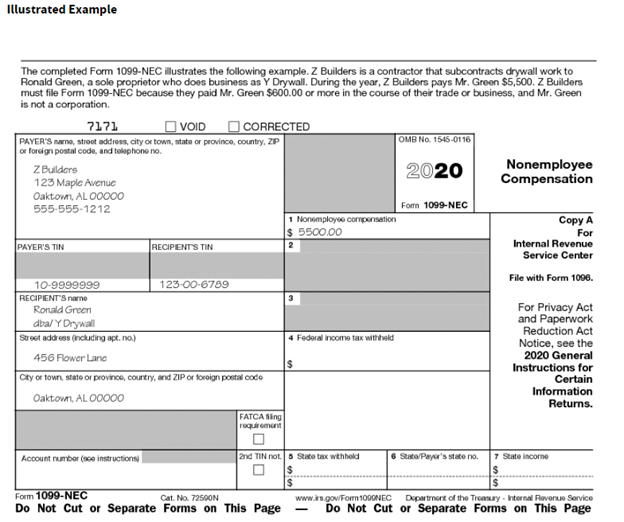

1099 Nec Form Printable - The 2020 1099 nec form isn’t an exception. For internal revenue service center. Businesses are required to send to people they paid more than $600 for services during the last calendar year. However, the issuer has reported your complete tin to the irs.fatca filing requirement. Both the forms and instructions will be updated as needed. Web for your protection, this form may show only the last four digits of your tin (social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein)). Current general instructions for certain information returns. Get printable sample & fill online latest news 1099 forms: Descriptions & purpose irs 1099 forms are essential documents used to report revenue to the internal revenue service (irs). For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec.

The 2020 1099 nec form isn’t an exception. Get printable sample & fill online latest news 1099 forms: Web send out signed 1099 forms for 2020 or print it rate the 1099 irs form 2020 4.8 satisfied 220 votes what makes the 1099 form 2020 legally valid? However, the issuer has reported your complete tin to the irs.fatca filing requirement. Current general instructions for certain information returns. For internal revenue service center. Both the forms and instructions will be updated as needed. Because the world takes a step away from office working conditions, the completion of documents more and more occurs online. Businesses are required to send to people they paid more than $600 for services during the last calendar year. Descriptions & purpose irs 1099 forms are essential documents used to report revenue to the internal revenue service (irs).

However, the issuer has reported your complete tin to the irs.fatca filing requirement. Get printable sample & fill online latest news 1099 forms: The 2020 1099 nec form isn’t an exception. Web for your protection, this form may show only the last four digits of your tin (social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein)). Both the forms and instructions will be updated as needed. Businesses are required to send to people they paid more than $600 for services during the last calendar year. For internal revenue service center. Descriptions & purpose irs 1099 forms are essential documents used to report revenue to the internal revenue service (irs). For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. Current general instructions for certain information returns.

1099NEC Recipient Copy B Cut Sheet HRdirect

Get printable sample & fill online latest news 1099 forms: Because the world takes a step away from office working conditions, the completion of documents more and more occurs online. For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. Web send out signed 1099 forms for 2020 or print it rate the 1099 irs form 2020 4.8 satisfied 220.

1099 Nec Form 2021 Fill and Sign Printable Template Online US Legal

For internal revenue service center. Web for your protection, this form may show only the last four digits of your tin (social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein)). For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. Both the forms and instructions will be updated as needed..

Form 1099NEC Instructions and Tax Reporting Guide

For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. Descriptions & purpose irs 1099 forms are essential documents used to report revenue to the internal revenue service (irs). Because the world takes a step away from office working conditions, the completion of documents more and more occurs online. Web for your protection, this form may show only the last.

[最も選択された] form 1099nec schedule c instructions 231161How to fill out

For internal revenue service center. Web for your protection, this form may show only the last four digits of your tin (social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein)). However, the issuer has reported your complete tin to the irs.fatca filing requirement. Descriptions & purpose irs 1099 forms are.

What the 1099NEC Coming Back Means for your Business Chortek

Both the forms and instructions will be updated as needed. Descriptions & purpose irs 1099 forms are essential documents used to report revenue to the internal revenue service (irs). The 2020 1099 nec form isn’t an exception. Web send out signed 1099 forms for 2020 or print it rate the 1099 irs form 2020 4.8 satisfied 220 votes what makes.

How to File Your Taxes if You Received a Form 1099NEC

Descriptions & purpose irs 1099 forms are essential documents used to report revenue to the internal revenue service (irs). Because the world takes a step away from office working conditions, the completion of documents more and more occurs online. Web send out signed 1099 forms for 2020 or print it rate the 1099 irs form 2020 4.8 satisfied 220 votes.

Nonemployee Compensation now reported on Form 1099NEC instead of Form

Because the world takes a step away from office working conditions, the completion of documents more and more occurs online. For internal revenue service center. Both the forms and instructions will be updated as needed. Businesses are required to send to people they paid more than $600 for services during the last calendar year. Get printable sample & fill online.

1099NEC Form Print Template for Word or PDF 1096 Transmittal Etsy

However, the issuer has reported your complete tin to the irs.fatca filing requirement. Both the forms and instructions will be updated as needed. Businesses are required to send to people they paid more than $600 for services during the last calendar year. The 2020 1099 nec form isn’t an exception. For internal revenue service center.

How To Fill Out A 1099 Nec Form By Hand Charles Leal's Template

Current general instructions for certain information returns. However, the issuer has reported your complete tin to the irs.fatca filing requirement. Web send out signed 1099 forms for 2020 or print it rate the 1099 irs form 2020 4.8 satisfied 220 votes what makes the 1099 form 2020 legally valid? Descriptions & purpose irs 1099 forms are essential documents used to.

What is Form 1099NEC for Nonemployee Compensation

Get printable sample & fill online latest news 1099 forms: Businesses are required to send to people they paid more than $600 for services during the last calendar year. Current general instructions for certain information returns. Descriptions & purpose irs 1099 forms are essential documents used to report revenue to the internal revenue service (irs). However, the issuer has reported.

The 2020 1099 Nec Form Isn’t An Exception.

Descriptions & purpose irs 1099 forms are essential documents used to report revenue to the internal revenue service (irs). Get printable sample & fill online latest news 1099 forms: However, the issuer has reported your complete tin to the irs.fatca filing requirement. Businesses are required to send to people they paid more than $600 for services during the last calendar year.

Web Send Out Signed 1099 Forms For 2020 Or Print It Rate The 1099 Irs Form 2020 4.8 Satisfied 220 Votes What Makes The 1099 Form 2020 Legally Valid?

For internal revenue service center. Web for your protection, this form may show only the last four digits of your tin (social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein)). Current general instructions for certain information returns. For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec.

Because The World Takes A Step Away From Office Working Conditions, The Completion Of Documents More And More Occurs Online.

Both the forms and instructions will be updated as needed.

![[最も選択された] form 1099nec schedule c instructions 231161How to fill out](https://efile360.com/images/forms-assets/Form 1099-NEC.png)